Business, 21.04.2020 02:22 Matseleng3775

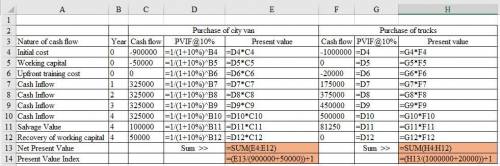

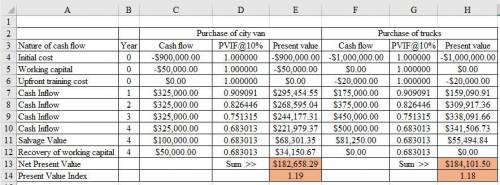

Swift Delivery is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrier to deliver the packages between the depots in the two cities. Swift Delivery recently acquired approximately $4 million of cash capital from its owners, and its president, George Hay, is trying to identify the most profitable way to invest these funds. Todd Payne, the company’s operations manager, believes that the money should be used to expand the fleet of city vans at a cost of $900,000. He argues that more vans would enable the company to expand its services into new markets, thereby increasing the revenue base. More specifically, he expects cash inflows to increase by $325,000 per year. The additional vans are expected to have an average useful life of four years and a combined salvage value of $100,000. Operating the vans will require additional working capital of $50,000, which will be recovered at the end of the fourth year. In contrast, Oscar Vance, the company’s chief accountant, believes that the funds should be used to purchase large trucks to deliver the packages between the depots in the two cities. The conversion process would produce continuing improvement in operating savings and reduce cash outflows as follows: Year 1 Year 2 Year 3 Year 4 $ 175,000 $ 375,000 $ 450,000 $ 500,000 The large trucks are expected to cost $1,000,000 and to have a four-year useful life and a $81,250 salvage value. In addition to the purchase price of the trucks, up-front training costs are expected to amount to $20,000. Swift Delivery’s management has established a 10 percent desired rate of return. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)

Required a.&b. Determine the net present value and present value index for each investment alternative. (Enter answers in whole dollar, not in million. Round your intermediate calculations and final answers to 2 decimal places.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 15:00, swansondonovanp66got

Ineed this asap miguel's boss asks him to distribute information to the entire staff about a mandatory meeting. in 1–2 sentences, describe what miguel should do.

Answers: 1

Business, 23.06.2019 03:00, oliviacalhoun29

If big macs were a durable good that could be costlessly transported between countries, which of the following would present an arbitrage opportunity? check all that apply. exporting big macs from argentina to the united states. exporting big macs from the united kingdom to poland. exporting big macs from switzerland to china

Answers: 1

Business, 23.06.2019 07:50, sarahlearn3

Tubby toys estimates that its new line of rubber ducks will generate sales of $7.60 million, operating costs of $4.60 million, and a depreciation expense of $1.60 million. if the tax rate is 35%, what is the firm’s operating cash flow? (enter your answer in millions rounded to 2 decimal places.)

Answers: 1

Business, 23.06.2019 12:00, milkshakegrande101

The "ideal" business, according to richard buskirk of the university of southern california: has many diverse employees. has a few, carefully selected employees. has many homogeneous employees. is a "one-man show".

Answers: 1

You know the right answer?

Swift Delivery is a small company that transports business packages between New York and Chicago. It...

Questions in other subjects:

Mathematics, 30.03.2021 19:50

Chemistry, 30.03.2021 19:50

Mathematics, 30.03.2021 19:50

English, 30.03.2021 19:50