Business, 21.04.2020 01:51 brucewayne390

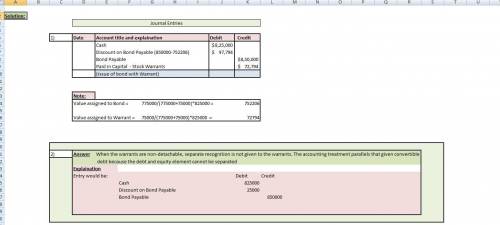

MagTech Inc. requires funding to build a new factory and has decided to raise the additional capital by issuing $850,000 face value of bonds with a coupon rate of 10%. In discussions with investment bankers, it was determined that to help the sale of the bonds, detachable stock warrants should be issued at the rate of 5 warrants for each $1,000 bond sold.

The value of the bonds without the warrants is considered to be $775,000, and the value of the warrants in the market is $75,000. The bonds sold in the market at issuance for $825,000.

Required:

(a) What entry should be made at the time of the issuance of the bonds and warrants?(b) If the warrants were nondetachable, would the entries be different? Discuss.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 14:00, tamariarodrigiez

How many months does the federal budget usually take to prepare

Answers: 1

Business, 22.06.2019 17:10, mikailah0988

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

Business, 22.06.2019 22:30, queenjay34

Upper a report about the decline of western investment in third world countries included this: "after years of daily flights comma several european airlines halted passenger service. foreign investment fell 400 percent during the 1990 s." what is wrong with this statement? choose the correct answer below. a. if foreign investment fell by 100 % comma it would be totally eliminated comma so it is not possible for it to fall by more than 100 %. b. the actual amount of the decrease in foreign investment is less than 100%. c. if foreign investment fell by 100%, it would be cut in half. thus, a decrease of 200% means that it would be totally eliminated, and a decrease of more than 200% is impossible. d. the statement does not mention the initial amount of foreign investment.

Answers: 3

You know the right answer?

MagTech Inc. requires funding to build a new factory and has decided to raise the additional capital...

Questions in other subjects:

English, 15.10.2019 06:00

Mathematics, 15.10.2019 06:00

Mathematics, 15.10.2019 06:00

Mathematics, 15.10.2019 06:00