Business, 21.04.2020 01:23 natetheman7740

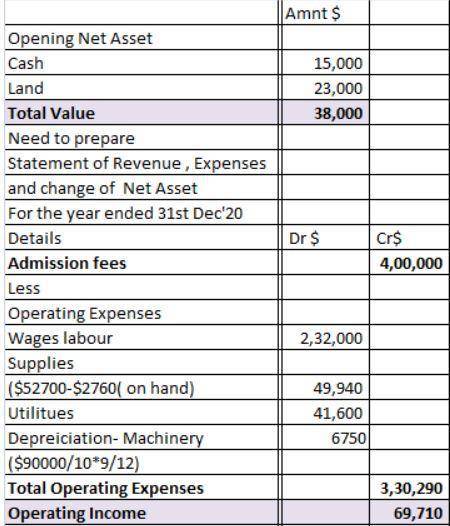

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anchorage Arboretum Authority. The Arboretum Authority is a component unit of the City of Anchorage and must be included in the City's financial statements. It began operations on January 1, 2020 with no outstanding liabilities or commitments and only 2 assets: (1) $15,000 cash and (2) land that it had paid $23,000 to acquire.

Cash Basis

12 months

Cash Receipts:

Admission fees 400,000

Borrowing from bank 80,000

Total deposits 480,000

Cash Disbursements:

Supplies 52,700

Labor 232,000

Utilities 41,600

Purchase of machinery 90,000

Interest on bank note 2,000

Total checks 418,900

Excess of Receipts over Disbursements: 61,100

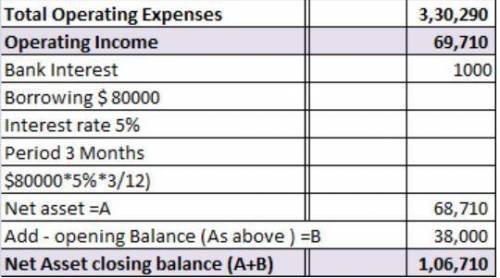

The loan from the bank is dated April 1 and is for a five year period. Interest (5% annual rate) is paid on Oct. 1 and April 1 of each year, beginning October 1, 2020.

The machinery was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful life of 10 years. (straight-line basis).

Supplies on hand amounted to $2,760 at December 31, 2020. These included $650 of fertilizer that was received on December 29 and paid in January 2020. All other bills and salaries related to 2020 had been paid by close of business on December 31.

Required:

Part A. Prepare a Statement of Revenues, Expenditures and Changes in Fund Balance for the year ended December 31, 2020 for the Arboretum assuming the City plans to account for its activities on the modified accrual basis.

Part B. Prepare a Statement of Revenues, Expenses and Changes in Net Position for the year ended December 31, 2020 for the Arboretum assuming the City plans to account for its activities on the accrual basis.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:50, Paytonsmommy09

Which of the following does not offer an opportunity for timely content? evergreen content news alerts content that suits seasonal consumption patterns content that matches a situational trigger content that addresses urgent pain points

Answers: 2

Business, 22.06.2019 14:50, QuarkyFermion

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 17:00, kamrulh278

During which of the following phases of the business cycle does the real gdp fall? a. trough b. expansion c. contraction d. peak

Answers: 2

Business, 22.06.2019 22:10, Har13526574

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anc...

Questions in other subjects:

Mathematics, 08.01.2020 20:31

Physics, 08.01.2020 20:31

Chemistry, 08.01.2020 20:31

Mathematics, 08.01.2020 20:31

English, 08.01.2020 20:31