Business, 15.04.2020 19:12 brookemcelhaney

You are an investment banker trying to value ABC Corp, a private software company. You have forecasted ABC’s free cash flows, but need to compute its WACC in order to value the firm. Unfortunately, ABC is private and so it does not have stock data, so you cannot use CAPM to find its cost of equity.

You know the following: ABC has debt of $200 at a cost of 5%; ABC recently raised money from equity investors, valuing the equity at $1,000. Further, Microsoft is in the same exact business as ABC, but it is public so you can see its cost of equity. Microsoft is financed with a constant debt-to-equity ratio of 1/9, has a cost of debt of 3%, a cost of equity of 20%, and a tax rate of 30%.

[Step 1: De-levering] Find the cost of unlevered equity for ABC (which is the same for Microsoft). Assume that Microsoft’s debt-to-equity ratio will stay constant forever.

A.18.3%

B.22.2%

C.22.5%

D.24.3%

[Step 2: Re-levering] Using the unlevered cost of capital for ABC above, find the cost of levered equity for ABC (assuming that ABC’s capital structure D/E will remain fixed).

A.23.32%

B.25.43%

C.20.96%

D.28.25%

Using your above two answers, find ABC’s WACC assuming it has the same tax rate as Microsoft.

A.20.05%

B.23.05%

C.25.05%

D.18.05%

Risk Free Rate is not provided yes

the formula De-levering no need risk free

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:30, kierafisher05

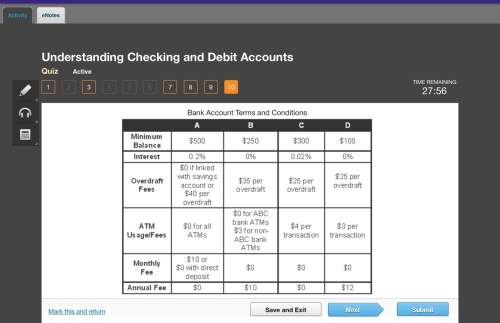

You wants to open a saving account. which account will grow his money the most

Answers: 1

Business, 22.06.2019 01:30, BaileyRyan8320

In the fall, jay thompson decided to live in a university dormitory. he signed a dorm contract under which he was obligated to pay the room rent for the full college year. one clause stated that if he moved out during the year, he could sell his dorm contract to another student who would move into the dormitory as his replacement. the dorm cost was $5000 for the two semesters, which jay had already paid a month after he moved into the dorm, he decided he would prefer to live in an apartment. that week, after some searching for a replacement to fulfill his dorm contract, jay had two offers. one student offered to move in immediately and to pay jay $300 per month for the eight remaining months of the school year. a second student offered to move in the second semester and pay $2500 to jay. jay estimates his food cost per month is $500 if he lives in the dorm and $450 if he lives in an apartment with three other students. his share of the apartment rent and utilities will be $404 per month. assume each semester is 4.5 months long. disregard the small differences in the timing of the disbursements or receipts. what is the cost of the cheapest alternative?

Answers: 1

Business, 22.06.2019 17:30, Jermlew

Google started as one of many internet search engines, amazon started as an online book seller, and ebay began as a site where people could sell used personal items in auctions. these firms have grown to be so large and dominant that they are facing antitrust scrutiny from competition regulators in the us and elsewhere. did these online giants grow by fairly beating competition, or did they use unfair advantages? are there any clouds on the horizon for these firms -- could they face diseconomies of scale or diseconomies of scope as they continue to grow? if so, what factors may limit their continued growth?

Answers: 1

Business, 22.06.2019 22:10, jeanieb

Consider the labor market for computer programmers. during the late 1990s, the value of the marginal product of all computer programmers increased dramatically. holding all else equal, what effect did this process have on the labor market for computer programmers? the equilibrium wagea. increased, and the equilibrium quantity of labor decreased. b. decreased, and the equilibrium quantity of labor increased. c. increased, and the equilibrium quantity of labor increased. d. decreased, and the equilibrium quantity of labor decreased.

Answers: 3

You know the right answer?

You are an investment banker trying to value ABC Corp, a private software company. You have forecast...

Questions in other subjects:

Mathematics, 03.12.2019 13:31

Mathematics, 03.12.2019 13:31

Engineering, 03.12.2019 13:31

Mathematics, 03.12.2019 13:31