Business, 11.04.2020 02:48 lealiastentz532542

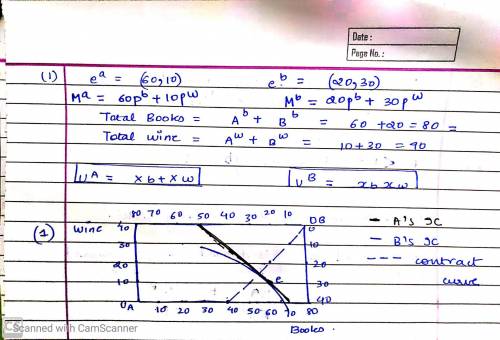

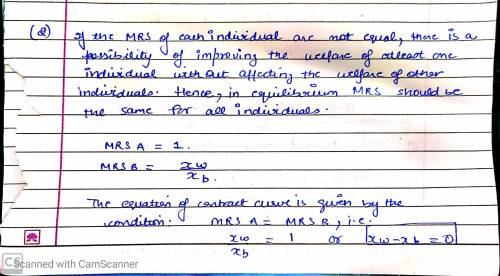

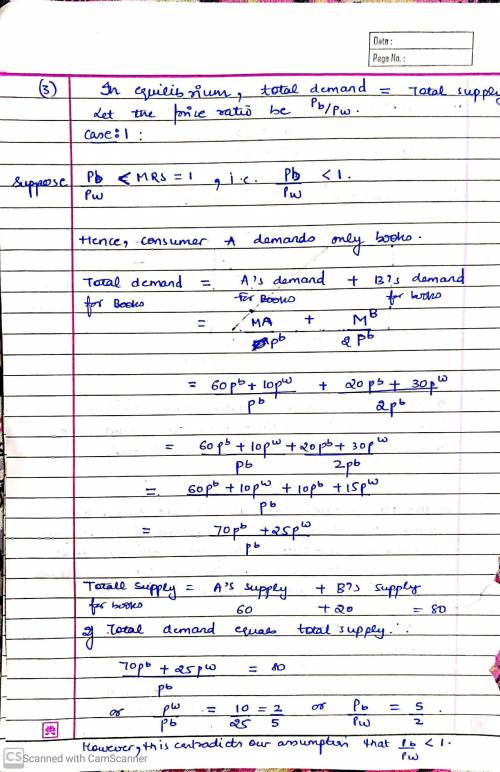

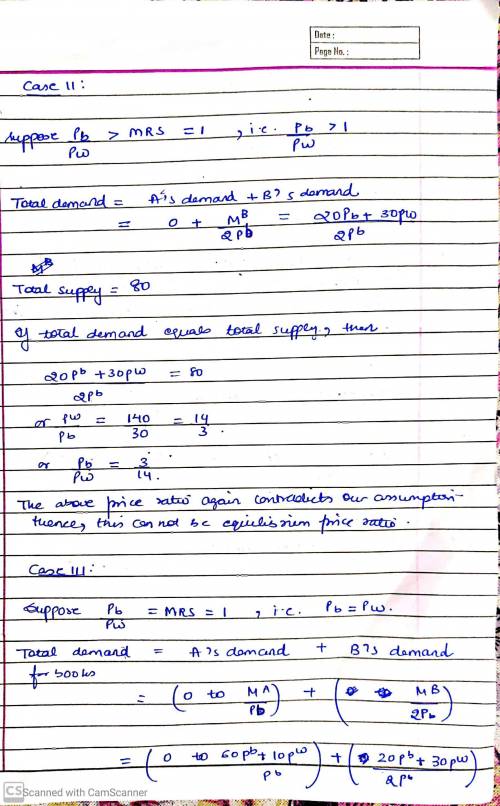

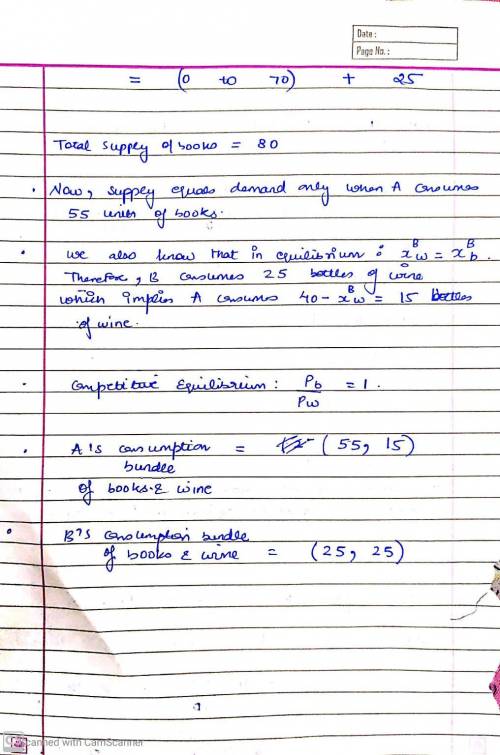

Two consumers, A and B, consume books and wine. Consumer A's initial endowment is (60, is, has has 60 books and 10 bottles of wine. Consumer endowment is (20,30). They have no other assets, and make no trades with anyone other than each other. For A, a book and a bottle of wine are perfect substitutes: her utility function is MA (zb, aw) acb zur, where arb is the number of books she consumes, and zu, is the number of bottle of wines she consumes. Consumer B's preferences are given by the utility function uB (Cb, acu) zbau (1) Draw an Edgeworth box with B's consumption measured from the upper right- hand corner of the box. On this diagram, mark the initial endowment, and label it e. Use red ink to draw A's indifference curve that passes through her initial endowment. use blue ink to draw B's indifference curve that passes through her initial endowment 2) At any Pareto optimal allocation, where both people consume some of each good it must be that their marginal rates of substitution are equal. Why? What are A and B's marginal rates of substitution? What is the equation of the contract curve? Use black ink to draw the contract curve on the diagram (3) In a competitive equilibrium, A will consume some books and wine. But in order for her to do so, what must the ratio of prices be? What is the competitive equilibrium of this exchange economy?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:00, QueenNerdy889

If a bond is issued at a premium the effective interest rate is most likely

Answers: 2

Business, 22.06.2019 13:10, KillerSteamcar

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 21:00, ilovecatsomuchlolol

Mr. beautiful, an organization that sells weight training sets, has an ordering cost of $40 for the bb-1 set. (bb-1 stands for body beautiful number 1.) the carrying cost for bb-1 is $5 per set per year. to meet demand, mr. beautiful orders large quantities of bb-1 seven times a year. the stockout cost for bb-1 is estimated to be $50 per set. over the past several years, mr. beautiful has observed the following demand during the lead time for bb-1: demand during lead time probability40 0.150 0.260 0.270 0.280 0.290 0.1total 1.0the reorder point for bb-1 is 60 sets. what level of safety stock should be maintained for bb-1?

Answers: 3

You know the right answer?

Two consumers, A and B, consume books and wine. Consumer A's initial endowment is (60, is, has has 6...

Questions in other subjects:

History, 30.06.2019 01:50