Business, 07.04.2020 23:07 versaceblooper

On September 30, 2016, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2017, and the program was available for release on April 30, 2017. Development costs were incurred as follows:

September 30 through December 31, 2016 $ 2,200,000

January 1 through February 28, 2017 800,000

March 1 through April 30, 2017 400,000

Athens expects a useful life of four years for the software and total revenues of $5,000,000 during that time. During 2017, revenue of $1,000,000 was recognized.

Required:

1.

Prepare the journal entries to record the development costs in 2016 and 2017. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

2.

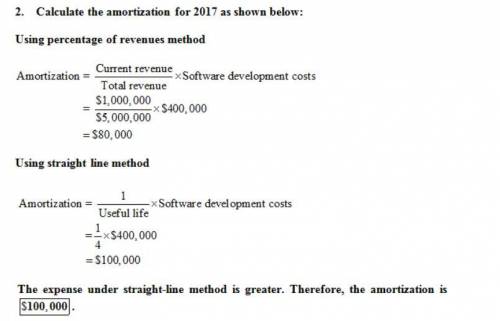

Calculate the required amortization for 2017. (Enter your answer in whole dollars.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:30, barn01

17. chef a says that garnish should be added to a soup right before serving. chef b says that garnish should be cooked with the other ingredients in a soup. which chef is correct? a. chef a is correct. b. both chefs are correct. c. chef b is correct. d. neither chef is correct. student c incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 14:00, bosskid361

Which of the following is not a characteristic of a weak economy? a. a low employment rateb. a high inflation ratec. a decreased gdpd. a high unemployment rate

Answers: 1

Business, 23.06.2019 00:10, bthomas78

Special order carson manufacturing, inc., sells a single product for $36 per unit. at an operating level of 8,000 units, variable costs are $18 per unit and fixed costs $10 per unit. carson has been offered a price of $20 per unit on a special order of 2,000 units by big mart discount stores, which would use its own brand name on the item. if carson accepts the order, material cost will be $3 less per unit than for regular production. however, special stamping equipment costing $4,000 would be needed to process the order; the equipment would then be discarded. assuming that volume remains within the relevant range, prepare an analysis of differential revenue and costs to determine whether carson should accept the special order. use a negative sign with answer to only indicate an income loss from special order; otherwise do not use negative signs with your answers.

Answers: 2

You know the right answer?

On September 30, 2016, Athens Software began developing a software program to shield personal comput...

Questions in other subjects:

Mathematics, 24.05.2021 18:50

Mathematics, 24.05.2021 18:50

History, 24.05.2021 18:50