Business, 07.04.2020 21:21 summerjoiner

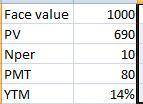

Bonds issued by the Coleman Manufacturing Company have a par value of $1,000, which of course is also the amount of principal to be paid at maturity. The bonds are currently selling for $690. They have 10 years remaining to maturity. The annual interest payment is 8 percent ($80). Compute the yield to maturity.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:10, gingerham1

Laws corporation is considering the purchase of a machine costing $16,000. estimated cash savings from using the new machine are $4,120 per year. the machine will have no salvage value at the end of its useful life of six years and the required rate of return for laws corporation is 12%. the machine's internal rate of return is closest to (ignore income taxes) (a) 12% (b) 14% (c) 16% (d) 18%

Answers: 1

Business, 22.06.2019 19:00, makaylahunt

James is an employee in the widget inspection department of xyz systems, a government contractor. james was part of a 3-person inspection team that found a particular batch of widgets did not meet the exacting requirements of the u. s. government. in order to meet the tight deadline and avoid penalties under the contract, james' boss demanded that the batch of widgets be sent in fulfillment of the government contract. when james found out, he went to the vice president of the company and reported the situation. james was demoted by his boss, and no longer works on government projects. james has a:

Answers: 3

Business, 22.06.2019 19:30, ssiy

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 23.06.2019 09:50, gabriellarose2930

Now, use your previously-computed value as an approximation for sigma, and compute how many ears of the experimental corn the researcher needs in the study. don't forget, the margin of error and confidence level have already been given to you in a previous problem.

Answers: 1

You know the right answer?

Bonds issued by the Coleman Manufacturing Company have a par value of $1,000, which of course is als...

Questions in other subjects:

Mathematics, 08.06.2021 20:30

History, 08.06.2021 20:30

Mathematics, 08.06.2021 20:30

English, 08.06.2021 20:30

Mathematics, 08.06.2021 20:30