Business, 07.04.2020 03:07 kellynadine02

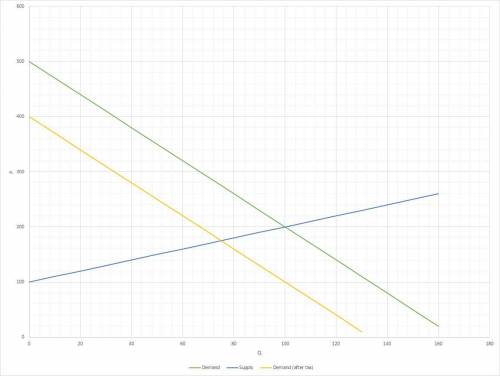

On January 1st, 2017, the city Philadelphia introduced a $1 tax on soda to raise money for the cityâs public schools while fighting childhood obesity. Suppose that before the tax, the supply and demand of soda are given by (prices are in cents): (inverse) Demand: P = 500 â 3Qd 100 (inverse) Supply: P = 100 + Qs 50 . Assume initially there are no externalities in the market for soda.

A consultant from the mayorâs office criticizes the tax plan. He says that, while the tax raises money for public schools, it does nothing to fight the child obesity epidemic and also points out that instead of getting money from "big soda", the tax in effect is a transfer from Philadelphia residents to the government

What assumptions from earlier in the question would you have to change so that this consultant is correct?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:30, dirtridersteve65

(select all that apply) examples of email use that could be considered unethical include denying receiving an e-mail requesting that you work late forwarding a chain letter asking for donations to a good cause sending a quick message to your friend about last weekend sending your boss the monthly sales figures in an attachment setting up a meeting with your co-worker sharing a funny joke with other employees

Answers: 2

Business, 22.06.2019 20:40, duhfiywge8885

Consider an economy where the government's budget is initially balanced. the production function, consumption function and investment function can be represented as follows y equals k to the power of alpha l to the power of 1 minus alpha end exponent c equals c subscript 0 plus b left parenthesis y minus t right parenthesis i equals i subscript 0 minus d r suppose that taxes increase. what happens to the equilibrium level of output?

Answers: 1

Business, 23.06.2019 02:40, rayzambr

Exercise 6-2 variable costing income statement; explanation of difference in net operating income [lo6-2] ida sidha karya company is a family-owned company located on the island of bali in indonesia. the company produces a handcrafted balinese musical instrument called a gamelan that is similar to a xylophone. the gamelans are sold for $970. selected data for the company’s operations last year follow: units in beginning inventory 0 units produced 200 units sold 180 units in ending inventory 20 variable costs per unit: direct materials $ 130 direct labor $ 300 variable manufacturing overhead $ 30 variable selling and administrative $ 15 fixed costs: fixed manufacturing overhead $ 63,000 fixed selling and administrative $ 25,000 the absorption costing income statement prepared by the company’s accountant for last year appears below: sales $ 174,600 cost of goods sold 139,500 gross margin 35,100 selling and administrative expense 27,700 net operating income $ 7,400 required: 1. under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. prepare an income statement for last year using variable costing.

Answers: 2

You know the right answer?

On January 1st, 2017, the city Philadelphia introduced a $1 tax on soda to raise money for the cityâ...

Questions in other subjects:

Social Studies, 17.06.2021 06:30

Mathematics, 17.06.2021 06:30

Mathematics, 17.06.2021 06:30

History, 17.06.2021 06:30

Mathematics, 17.06.2021 06:30

Mathematics, 17.06.2021 06:30