Business, 07.04.2020 01:26 emmmmmily997

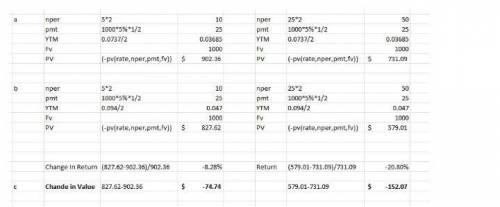

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bonds.

Bond A Bond B

Coupon rate 5.00% 5.00%

Time to maturity 5 years 25 years

Required return 7.37% 7.37%

a. Calculate the values of Bond A and Bond B. (Round your answers to 2 decimal places.)

b. Recalculate the bonds’ values if the required rate of return changes to 9.40%. (Round your answers to 2 decimal places.)

c. Calculate the increase or decrease in bond value based on the change in required return. (Round your answers to 2 decimal places.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:30, dabicvietboi

Which of the following is an example of a positive externality? a. promoting generic drugs would benefit people. b. a lower inflation rate would benefit most consumers. c. compulsory flu shots for all students prevents the spread of illness in the general public. d. singapore has adopted a comprehensive savings plan for all workers known as the central provident fund.

Answers: 1

Business, 22.06.2019 17:00, jaymoney0531

Can someone me ? i’ll mark the best answer brainliest : )

Answers: 1

Business, 22.06.2019 19:20, natajayd

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

Business, 22.06.2019 19:40, silasjob09

The martinez legal firm (mlf) recently acquired a smaller competitor, miller and associates, which specializes in issues not previously covered by mlf, such as land use and intellectual property cases. given the increase in the firm's size and complexity, it is likely that its internal transaction costs willa. decrease. b. increase. c. become external transaction costs. d. be eliminated.

Answers: 3

You know the right answer?

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bon...

Questions in other subjects:

Mathematics, 31.08.2021 23:10

Mathematics, 31.08.2021 23:10

Mathematics, 31.08.2021 23:10

English, 31.08.2021 23:10

Mathematics, 31.08.2021 23:10