Leach Inc. experienced the following events for the first two years of its operations:

...

Business, 06.04.2020 22:32 friendsalwaysbae

Leach Inc. experienced the following events for the first two years of its operations:

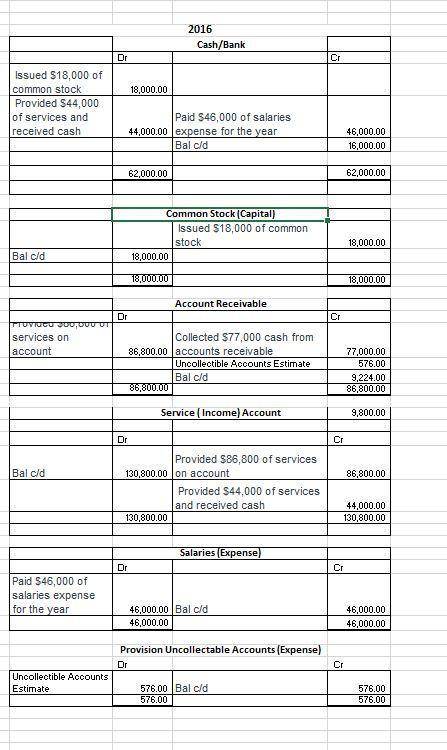

2016:

1. Issued $18,000 of common stock for cash.

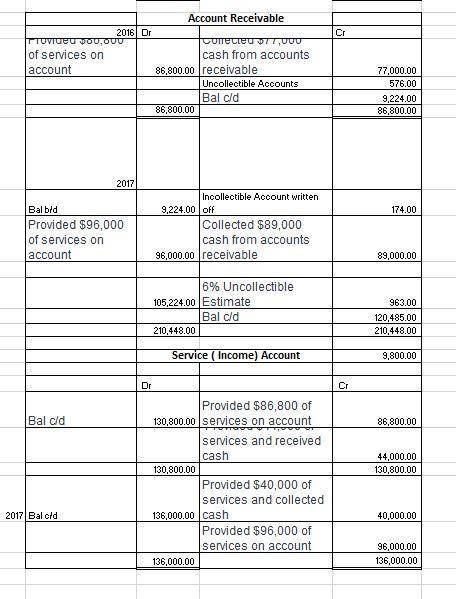

2. Provided $86,800 of services on account.

3. Provided $44,000 of services and received cash.

4. Collected $77,000 cash from accounts receivable.

5. Paid $46,000 of salaries expense for the year.

6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible.

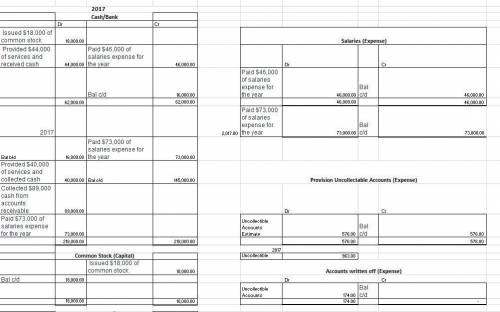

2017:

1. Wrote off an uncollectible account for $750.

2. Provided $96,000 of services on account.

3. Provided $40,000 of services and collected cash.

4. Collected $89,000 cash from accounts receivable.

5. Paid $73,000 of salaries expense for the year.

6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible.

Required:

(a) Record 2016 events in the general journal form and post them to T-accounts.

(b) Repeat part (a) for 2017.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:00, kay4173

Answer the following questions using the data given below. annual percent return on mutual funds (n = 17) last year (x) this year (y) 11.9 15.4 19.5 26.7 11.2 18.2 14.1 16.7 14.2 13.2 5.2 16.4 20.7 21.1 11.3 12.0 –1.1 12.1 3.9 7.4 12.9 11.5 12.4 23.0 12.5 12.7 2.7 15.1 8.8 18.7 7.2 9.9 5.9 18.9

Answers: 3

Business, 22.06.2019 08:00, savannahworkman11

How do communism and socialism differ in terms of the role that government plays in the economy ?

Answers: 1

Business, 22.06.2019 10:30, karnun1201

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 11:10, addsd

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

You know the right answer?

Questions in other subjects:

Biology, 09.04.2020 22:17

Mathematics, 09.04.2020 22:17

Mathematics, 09.04.2020 22:17

Mathematics, 09.04.2020 22:17

History, 09.04.2020 22:17