Business, 04.04.2020 13:00 adjjones2011

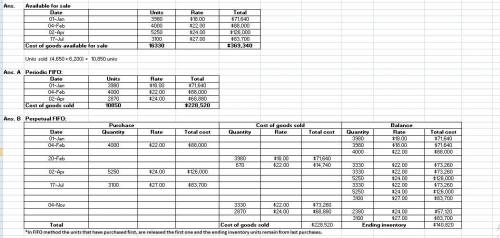

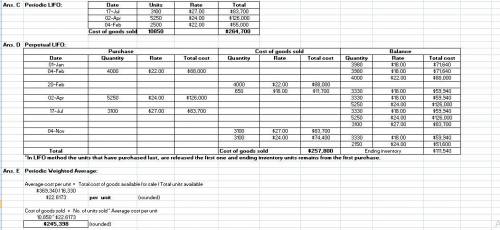

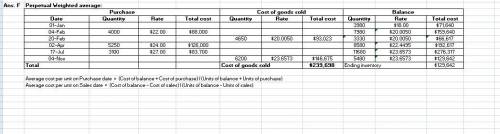

(8 points) Ehlo Company is a multiproduct firm. Presented below is information concerning one of its products, the Hawkeye. Date Transaction Quantity Price/Cost 1/1 Beginning inventory 3,980 $18 2/4 Purchase 4,000 22 2/20 Sale 4,650 4/2 Purchase 5,250 24 7/17 Purchase 3,100 27 11/4 Sale 6,200.Compute cost of goods sold, assuming Ehlo uses:a. Periodic system, FIFO cost flowb. Perpetual system, FIFO cost flowc. Periodic system, LIFO cost flowd. Perpetual system, LIFO cost flowe. Periodic system, weighted=average cost flowf. Perpetual system, moving-average cost flow

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:30, trinitieu66

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 17:40, libi052207

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 20:10, elora2007

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept, the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year. to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

You know the right answer?

(8 points) Ehlo Company is a multiproduct firm. Presented below is information concerning one of its...

Questions in other subjects:

History, 23.01.2021 05:10

Physics, 23.01.2021 05:10

History, 23.01.2021 05:10