Business, 31.03.2020 04:03 gabegabemm1

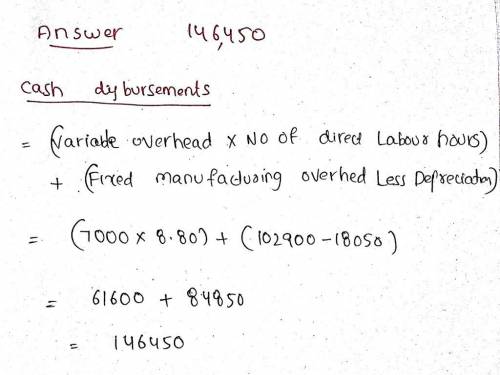

The manufacturing overhead budget at Polich Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 7,000 direct labor-hours will be required in February. The variable overhead rate is $8.80 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $102,900 per month, which includes depreciation of $18,050. All other fixed manufacturing overhead costs represent current cash flows. The February cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:10, XOsam

Coca-cola was primarily known for its core competencies in marketing, bottling, and distributing aerated drinks. however, with the success of gatorade, coca-cola developed competencies in the development and marketing of its own sports drink, powerade. which of the following is true of coca-cola? a. it is leveraging existing core competencies to improve current market position. b. it is building new core competencies to protect and extend its current market position. c. it is redeploying and recombining existing core competencies to compete in markets of the future. d. it is targeting the chasm between the early adopter and early majority market segment.

Answers: 1

Business, 22.06.2019 21:10, kmacho9726

Krier industries has just completed its sales forecasts and its marketing department estimates that the company will sell 43,800 units during the upcoming year. in the past, management has maintained inventories of finished goods at approximately 3 months' sales. however, the estimated inventory at the start of the year of the budget period is only 7,300 units. sales occur evenly throughout the year. what is the estimated production level (units) for the first month of the upcoming budget year?

Answers: 3

Business, 22.06.2019 21:10, tonimgreen17p6vqjq

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 22.06.2019 22:00, ednalovegod

He interest rate effect is the change in real gdp caused by the federal reserve adjusting target interest rates. is the change in consumer and investment spending due to changes in interest rates resulting from changes in the aggregate price level. is the change in exports and imports, resulting from changes in the interest rate caused by changes in the aggregate price level. is the change in investment spending and government purchases caused by changes in money demand. is the change in interest rates, caused by changes to government purchases.

Answers: 2

You know the right answer?

The manufacturing overhead budget at Polich Corporation is based on budgeted direct labor-hours. The...

Questions in other subjects:

Mathematics, 01.09.2020 14:01

History, 01.09.2020 14:01

Biology, 01.09.2020 14:01

History, 01.09.2020 14:01

English, 01.09.2020 14:01

Mathematics, 01.09.2020 14:01