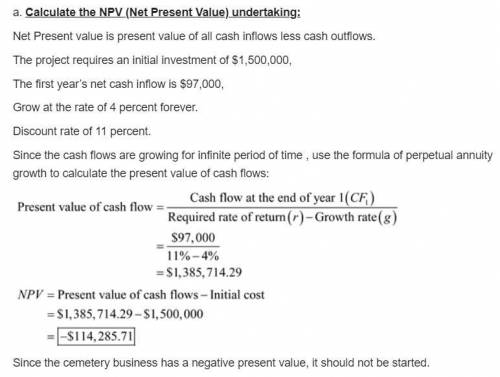

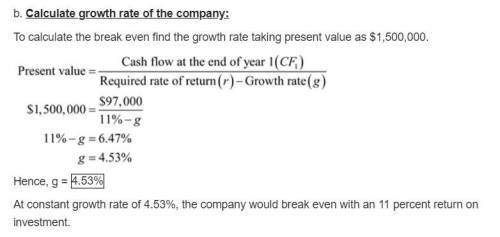

The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up." As a result, the cemetery project will provide a net cash inflow of $97,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4% per year for the following 5 years, at which time the business will be closed. The project requires an initial investment of $1,500,000. If Yurdone requires an 11% return, should the cemetery business be started? (Note: to calculate the next years cash flow, multiply last years cash flow by 1 + the growth rate. For example, cash flow for year 2 will be $97,000*(1+4%) = $100,880 ).

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:40, JusSomeRandomGuy

Which economic indicators are used to measure the global economy? check all that apply. a. purchasing power parity b. trade volumes c. spending power parity d. labor market data e. gross domestic product f. trade deficits and surpluses

Answers: 3

Business, 22.06.2019 15:00, cheyfaye4173

Oerstman, inc. uses a standard costing system and develops its overhead rates from the current annual budget. the budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours.(practical capacity is 500,000 hours)annual budgeted overhead costs total $772,800, of which $556,800 is fixed overhead. a total of 119,300 units, using 478,000 direct labor hours, were produced during the year. actual variable overhead costs for the year were $260,400 and actual fixed overhead costs were $555,450.required: 1. compute the fixed overhead spending variance and indicate if favorable or unfavorable.2. compute the fixed overhead volume variance and indicate if favorable or unfavorable.

Answers: 3

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 21:50, preguntassimples

Assume that (i) setups need to be completed first; (ii) a setup can only start once the batch has arrived at the resource, and (iii) all flow units of a batch need to be processed at a resource before any of the units of the batch can be moved to the next resource. process step 1 molding 2 painting 3 dressing setup time 15 min. 30 min. no setup processing time 0.25 min./unit 0.15 min./unit 0.30 min./unit which batch size would minimize inventory without decreasing the process capacity?

Answers: 1

You know the right answer?

The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M....

Questions in other subjects:

Mathematics, 27.01.2020 22:31

English, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

History, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

Biology, 27.01.2020 22:31