Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 15:30, jayzelgaspar8441

Jen heard that the bank where she kept her money was going to close for good. jen said she wasn't worried

Answers: 3

Business, 22.06.2019 10:30, karnun1201

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 11:30, kimjp56io5

Amano s preguntes cationing to come fonds and consumer good 8. why did the u. s. government use rationing for some foods and consumer goods during world war ii?

Answers: 1

Business, 22.06.2019 21:30, kaitlngley2367

Which is the most compelling reason why mobile advertising is related to big data?

Answers: 1

You know the right answer?

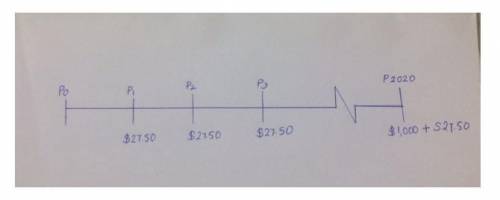

Consider a 10-year bond with a face value of $ 1 comma 000 that has a coupon rate of 5.1 %, with sem...

Questions in other subjects:

History, 14.02.2020 04:28

Mathematics, 14.02.2020 04:28

Mathematics, 14.02.2020 04:28

Biology, 14.02.2020 04:28

Mathematics, 14.02.2020 04:28