Business, 25.03.2020 06:58 dmurdock1973

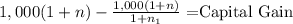

You are considering buying a bond that will be issued today. It will mature in m years. The annual coupon rate is n%. Face value is $1,000. The annual market rate is (n 1)%. a) What is the capital gains yield at exactly a year before the bond matures, when only one coupon and face value are left to be paid, if the market rate stays the same through the years

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 12:20, lamwil9432

Selected transactions of the carolina company are listed below. classify each transaction as either an operating activity, an investing activity, a financing activity, or a noncash activity. 1. common stock is sold for cash above par value. 2. bonds payable are issued for cash at a discount

Answers: 2

Business, 22.06.2019 14:40, nathenq1839

Which of the following would classify as a general education requirement

Answers: 1

Business, 22.06.2019 20:00, jakepeavy70

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

Business, 23.06.2019 00:00, AaronMicrosoft15

Winston churchill's stamp collection was valued at $14 million when he died. at auction, it brought in only $4 million. what was it worth? why?

Answers: 3

You know the right answer?

You are considering buying a bond that will be issued today. It will mature in m years. The annual c...

Questions in other subjects:

Mathematics, 23.04.2021 18:00

English, 23.04.2021 18:00

Mathematics, 23.04.2021 18:00