Business, 25.03.2020 01:35 esdoles3865

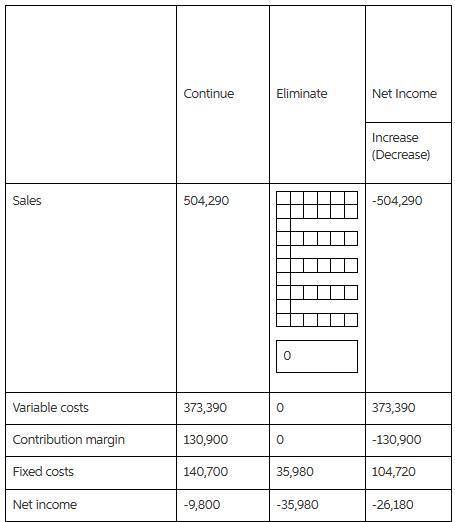

Gator Corporation manufactures several types of accessories. For the year, the gloves and mittens line had sales of $488,000, variable expenses of $368,000, and fixed expenses of $143,000. Therefore, the gloves and mittens line had a net loss of $23,000. If Gator eliminates the line, $42,000 of fixed costs will remain. Prepare an analysis showing whether the company should eliminate the gloves and mittens line. (Enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. (45).)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 15:30, gwoodbyrne

Thirty years ago daniel bought a plot of land for $50,000 when the cpi was 50. now the cpi is 180 and he sold the land for $180,000. what issue might inflation cause for daniel?

Answers: 2

Business, 21.06.2019 18:30, lanaasad7292

Which stroke of the four-stroke cycle is shown in the above figure? a. power b. compression c. exhaust d. intake

Answers: 2

Business, 22.06.2019 04:00, elijahcraft3

Wallis company manufactures only one product and uses a standard cost system. the company uses a predetermined plantwide overhead rate that relies on direct labor-hours as the allocation base. all of the company's manufacturing overhead costs are fixed—it does not incur any variable manufacturing overhead costs. the predetermined overhead rate is based on a cost formula that estimated $2,886,000 of fixed manufacturing overhead for an estimated allocation base of 288,600 direct labor-hours. wallis does not maintain any beginning or ending work in process inventory.

Answers: 2

You know the right answer?

Gator Corporation manufactures several types of accessories. For the year, the gloves and mittens li...

Questions in other subjects:

Mathematics, 26.02.2022 15:40

Mathematics, 26.02.2022 15:40