Business, 24.03.2020 18:02 elricardo34

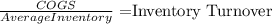

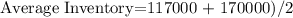

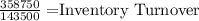

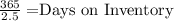

Suppose at December 31 of a recent year, the following information (in thousands) was available for sunglasses manufacturer Oakley Inc.: ending inventory $170,000; beginning inventory $117,000; cost of goods sold $358,750 and sales revenue $770,000. Calculate the inventory turnover for Oakley, Inc. (Round inventory turnover to 2 decimal places, e. g. 5.12.) Inventory turnover enter inventory turnover ratio rounded to 2 decimal places times eTextbook and Media List of Accounts Calculate the days in inventory for Oakley, Inc. (Round days in inventory to 0 decimal places, e. g. 125.) Days in inventory enter days in inventory rounded to the nearest whole days

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:10, ridzrana02

Belstone, inc. is a merchandiser of stone ornaments. it sold 15,000 units during the year. the company has provided the following information: sales revenue $ 520,000 purchases (excluding freight in) 338,500 selling and administrative expenses 32,000 freight in 15,000 beginning merchandise inventory 43,000 ending merchandise inventory 58,500 how much is the gross profit for the year?

Answers: 3

Business, 22.06.2019 04:50, toyaluv2013

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses. you are eligible to work within the state. you are eligible to sell limited investment securities. you are eligible to sell fixed income investment products. your compensation is fee based. section 6 section 7 section 63 section 65

Answers: 3

Business, 22.06.2019 13:50, veronica25681

When used-car dealers signal the quality of a used car with a warranty, a. buyers believe the signal because the cost of a false signal is high b. it is not rational to believe the signal because some used-car dealers are crooked c. the demand for lemons is eliminated d. the price of a lemon rises above the price of a good used car because warranty costs on lemons are greater than warranty costs on good used cars

Answers: 2

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

You know the right answer?

Suppose at December 31 of a recent year, the following information (in thousands) was available for...

Questions in other subjects:

Chemistry, 17.12.2021 03:00

Biology, 17.12.2021 03:00

Mathematics, 17.12.2021 03:00