Business, 24.03.2020 02:24 strodersage

SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 4,000 of these meals using 960 direct labor-hours. The company paid its direct labor workers a total of $19,200 for this work, or $20.00 per hour.

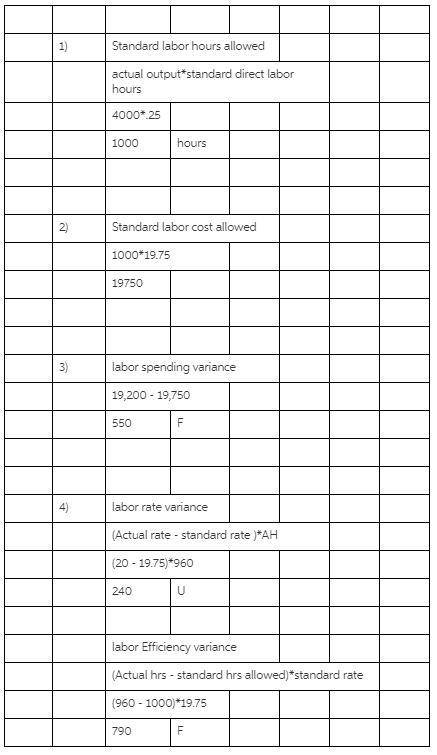

1. What is the standard labor-hours allowed (SH) to prepare 4,000 meals?

2. What is the standard labor cost allowed (SH x SR) to prepare 4,000 meals?

3. What is the labor spending variance?

4. What is the labor rate variance and the labor efficiency variance?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:50, smariedegray

Acompany set up a petty cash fund with $800. the disbursements are as follows: office supplies $300 shipping $50 postage $30 delivery expense $350 to create the fund, which account should be credited? a. postage b. cash at bank c. supplies d. petty cash

Answers: 2

Business, 22.06.2019 03:30, skylar1315

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

You know the right answer?

SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s produc...

Questions in other subjects:

Mathematics, 16.12.2019 07:31

English, 16.12.2019 07:31