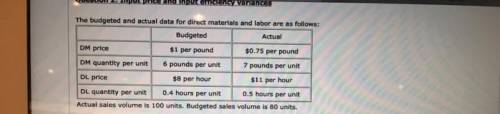

Next, compute the variances. Enter favorable variances as a positive number and unfavorable variances as a negative number. Do NOT enter F or U. input price variance for DM = $ Incorrect: Your answer is incorrect. input efficiency variance for DM = $ input price variance for DL = $ input efficiency variance for DL

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, BaileyRyan8320

In the fall, jay thompson decided to live in a university dormitory. he signed a dorm contract under which he was obligated to pay the room rent for the full college year. one clause stated that if he moved out during the year, he could sell his dorm contract to another student who would move into the dormitory as his replacement. the dorm cost was $5000 for the two semesters, which jay had already paid a month after he moved into the dorm, he decided he would prefer to live in an apartment. that week, after some searching for a replacement to fulfill his dorm contract, jay had two offers. one student offered to move in immediately and to pay jay $300 per month for the eight remaining months of the school year. a second student offered to move in the second semester and pay $2500 to jay. jay estimates his food cost per month is $500 if he lives in the dorm and $450 if he lives in an apartment with three other students. his share of the apartment rent and utilities will be $404 per month. assume each semester is 4.5 months long. disregard the small differences in the timing of the disbursements or receipts. what is the cost of the cheapest alternative?

Answers: 1

Business, 22.06.2019 08:40, kamarionnatillman13

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u. s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 16:20, Zshotgun33

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 23:50, yatayjenings12

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

You know the right answer?

Next, compute the variances. Enter favorable variances as a positive number and unfavorable variance...

Questions in other subjects:

History, 16.09.2021 14:00

Mathematics, 16.09.2021 14:00

Biology, 16.09.2021 14:00

Chemistry, 16.09.2021 14:00

Social Studies, 16.09.2021 14:00