Business, 23.03.2020 22:33 jeremiahhart13

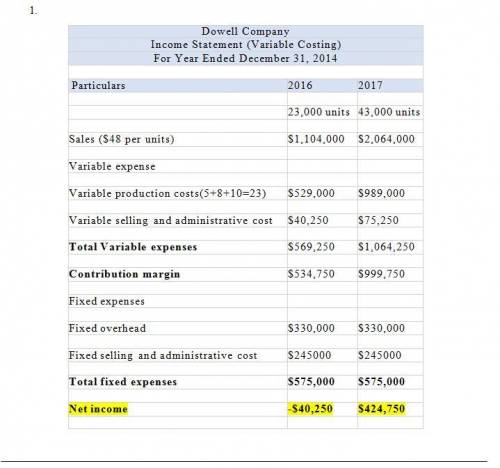

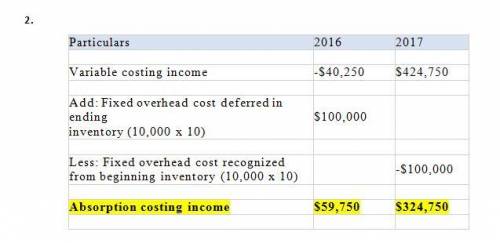

Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. 2016 2017 Sales ($48 per unit) $ 1,104,000 $ 2,064,000 Cost of goods sold ($33 per unit) 759,000 1,419,000 Gross margin 345,000 645,000 Selling and administrative expenses 297,500 347,500 Net income $ 47,500 $ 297,500 Additional Information Sales and production data for these first two years follow. 2016 2017 Units produced 33,000 33,000 Units sold 23,000 43,000 Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company's $33 per unit product cost consists of the following. Direct materials $ 5 Direct labor 8 Variable overhead 10 Fixed overhead ($330,000/33,000 units) 10 Total product cost per unit $ 33 Selling and administrative expenses consist of the following. 2016 2017 Variable selling and administrative expenses ($2.5 per unit) $ 57,500 $ 107,500 Fixed selling and administrative expenses 240,000 240,000 Total selling and administrative expenses $ 297,500 $ 347,500 . What are the differences between the absorption costing income and the variable costing income for these two years?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 19:20, kimmosley80

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

Business, 22.06.2019 19:30, janayshas84

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

Business, 23.06.2019 07:00, kris22elizondop9v1bb

Ricardo conducts a survey to learn where consumers get information for buying used cars. this is an example of

Answers: 1

You know the right answer?

Dowell Company produces a single product. Its income statements under absorption costing for its fir...

Questions in other subjects:

English, 26.10.2020 04:20

Mathematics, 26.10.2020 04:20

Mathematics, 26.10.2020 04:20

Mathematics, 26.10.2020 04:30