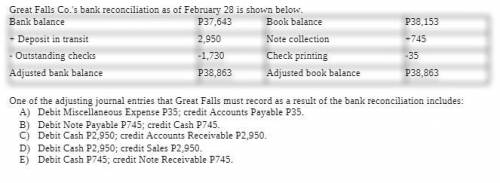

Great Falls Co's bank reconciliation as of February 28 is shown below $38,153 +745 -35 $37,643 Book balance Bank balance + Deposit in transit 2,950 Note collection -1,730 Check printing Outstanding checks Adjusted bank balance 538,863 $38,863 Adjusted book balance

One of the adjusting journal entries that Great Falls must record as a result of the bank reconciliation includes.

a. Debit Cash $2,950; credit Accounts Receivable $2,950.

b. Debit Miscellaneous Expense $35; credit Accounts Payable $35.

c. Debit Cash $745; credit Note Receivable $745.

d. Debit Cash $2,950; credit Sales $2,950.

e. Debit Note Payable $745; credit Cash $745.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:30, cacaface311

Miko willingly admits that she is not an accountant by training. she is concerned that her balance sheet might not be correct. she has provided you with the following additional information. 1. the boat actually belongs to miko, not to skysong, inc.. however, because she thinks she might take customers out on the boat occasionally, she decided to list it as an asset of the company. to be consistent, she also listed as a liability of the corporation her personal loan that she took out at the bank to buy the boat. 2. the inventory was originally purchased for $27,500, but due to a surge in demand miko now thinks she could sell it for $39,600. she thought it would be best to record it at $39,600. 3. included in the accounts receivable balance is $11,000 that miko loaned to her brother 5 years ago. miko included this in the receivables of skysong, inc. so she wouldn’t forget that her brother owes her money. (b) provide a corrected balance sheet for skysong, inc.. (hint: to get the balance sheet to balance, adjust stockholders’ equity.) (list assets in order of liquidity.)

Answers: 1

Business, 22.06.2019 09:00, nicoleaaliyah

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 17:30, gena75

Betty contracted with scooby’s skate store to deliver a pair of skates to jake for his birthday. scooby’s owner was going on a trip and delegated the delivery of the skates to brian. brian failed to make delivery. can jake sue brian for breach of contract, as he was not a party to the original contract? explain your answer. brian was not a party to the original contract. why would a court hold him responsible for failing to make delivery? if you do not think a court would hold him responsible, explain your answer. can jake sue scooby’s skates for breach of contract? explain your answer.

Answers: 2

You know the right answer?

Great Falls Co's bank reconciliation as of February 28 is shown below $38,153 +745 -35 $37,643 Book...

Questions in other subjects:

Mathematics, 06.11.2020 17:30

Mathematics, 06.11.2020 17:30

Mathematics, 06.11.2020 17:30

History, 06.11.2020 17:30