The Frooty Company is a family-owned business that produces fruit jam. The company has a grinding machine that has been in use for 3 years. On January 1, 2014, Frooty is considering the purchase of a new grinding machine. Frooty has two options: (1) continue using the old machine or (2) sell the old machine and purchase a new machine. The seller of the new machine isn’t offering a trade-in. The following information has been obtained:

Old Machine New Machine

The initial purchase cost of machines $150,000 $190,000

Useful life from acquisition date (years)

Expected annual cash operating costs

Variable cost per can of jam $0.25 $0.19

Total fixed costs $25,000 $24,000

Depreciation method for tax purposes MACRS, 7-year asset MACRS, 5-year asset

Estimated disposal value of machines

January 1, 2014 $68,000 $190,000

December 31, 2018 $12,000 $22,000

Expected cans of jam produced and sold each year

Frooty is subject to a 34% income tax rate. Assume that any gain or loss on the sale of machines is treated as an ordinary tax item and will affect the taxes paid by Frooty in the year in which it occurs. Frooty’s after-tax required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts.

Required:

1. A manager at Frooty asks you whether it should buy the new machine. To help in your analysis, calculate the following:

a. One-time after-tax cash effect of disposing of the old machine on January 1, 2014

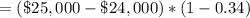

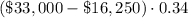

b. The after-tax cash operating costs of keeping the old machine, of buying the new machine, and the difference between the two values (variable and fixed).

c. The total difference between the depreciation tax shield (DTS) resulting from keeping the old machine and buying the new machine.

d. The difference in after-tax cash flow from the terminal disposal of new machine and old machine

2. Use the net present value method to determine whether Frooty should use the old machine or acquire the new machine. Calculate the NPV of each option the way it was done in class. Check the NPV calculations using the NPV function in Excel.

3. How much more or less would the recurring after-tax cash operating savings of the new machine need to be for Frooty to be indifferent about whether to keep the old machine or buy the new machine? Assume that all other data about the investment do not change

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:10, gingerham1

Laws corporation is considering the purchase of a machine costing $16,000. estimated cash savings from using the new machine are $4,120 per year. the machine will have no salvage value at the end of its useful life of six years and the required rate of return for laws corporation is 12%. the machine's internal rate of return is closest to (ignore income taxes) (a) 12% (b) 14% (c) 16% (d) 18%

Answers: 1

Business, 22.06.2019 19:50, ahoney2233

Statistical process control charts: a. indicate to the operator the true quality of material leaving the process. b. display upper and lower limits for process variables or attributes and signal when a process is no longer in control. c. indicate to the process operator the average outgoing quality of each lot. d. display the measurements on every item being produced. e. are a graphic way of classifying problems by their level of importance, often referred to as the 80-20 rule.

Answers: 2

Business, 22.06.2019 20:20, jskdkfjf

Fractional reserve banking which of the following statements about fractional reserve banking are correct? check all that apply. fractional reserve banking allows banks to create money through the lending process. fractional reserve banking does not allow banks to hold excess reserves. fractional reserve banking allows banks to create additional wealth by lending some reserves. fractional reserve banking relies on everyone not withdrawing their money at the same time.

Answers: 2

Business, 22.06.2019 20:40, Jacobstoltzfus

Review the wbs and gantt chart you created previously. propose three to five additional activities that would you estimate resources and durations. now, identify at least eight milestones for the recreation and wellness intranet project. remember that milestones normally have no duration, so you must have tasks that will lead to completing the milestone. add your activities and milestones to your gantt chart, creating a new gantt chart. estimate the task durations and enter dependencies as appropriate. remember that your schedule goal for the project is six months. copy the gantt chart and network diagram to a word document.

Answers: 2

You know the right answer?

The Frooty Company is a family-owned business that produces fruit jam. The company has a grinding ma...

Questions in other subjects:

English, 25.02.2020 06:22

Mathematics, 25.02.2020 06:22

Chemistry, 25.02.2020 06:22

English, 25.02.2020 06:22

Physics, 25.02.2020 06:22

Biology, 25.02.2020 06:22

= $18,810 (in favor of new machine)

= $18,810 (in favor of new machine)

= $660 (in favor of new machine)

= $660 (in favor of new machine)

= $5,695 (in favor of new machine)

= $5,695 (in favor of new machine)