Woolman College is considering the construction of a new women’s dormitory. The dormitory will have 80 rooms and the ability to accommodate three students per room. Woolman estimates the dormitory will cost $1.8 million and will have a useful life of 30 years with no salvage value. Using information from existing dorms, Woolman knows the following about each cost:

A linear regression was performed for utility costs (dependent variable) and housing revenue (independent variable), with an adjusted R2 = 0.5. In a separate regression to determine causation they found a total cost function for utility costs with a y-intercept of 22,000 and an x-coefficient of 0.05. All historical data were annual amounts.

Supplies = $ 350 / student (per year)

Insurance = $ 40,000 / year

Repair and Maint. = $ 32,000 / year

Resident assistants – One resident assistant is needed for every 45 students. Each resident assistant is paid $7,000 / year in salary.

Given the above information, please answer the following information.

If Woolman charges $ 3,100 / student for annual housing in the dormitory, what is the contribution margin per student?

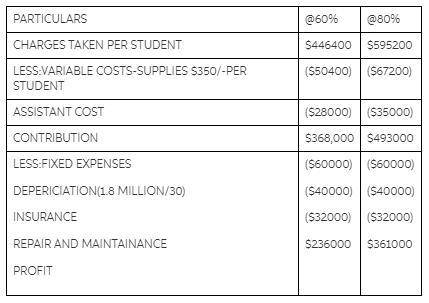

Prepare a contribution margin income statement to show the profit generated from this new dorm if it is 60% full? If it is 80% full?

What is the cost per student (including variable and fixed costs) at 60% capacity? At 80% capacity?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 11:00, idontknow1993

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 22.06.2019 11:00, littlesami105

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 15:00, AldecuaF10

Beagle autos is known for its affordable and reliable brand of consumer vehicles. because its shareholders expect to see an improved rate of growth in the coming years, beagle's executives have decided to diversify the company's range of products so that at least 40 percent of the firm's revenue is generated by new business units. however, the company's resources, capabilities, and competencies are limited to producing other forms of motorized vehicles, such as motorcycles and all-terrain vehicles (atvs). which type of corporate diversification strategy should beagle pursue?

Answers: 1

You know the right answer?

Woolman College is considering the construction of a new women’s dormitory. The dormitory will have...

Questions in other subjects:

Mathematics, 16.06.2020 04:57

Mathematics, 16.06.2020 04:57

Chemistry, 16.06.2020 04:57

Physics, 16.06.2020 04:57