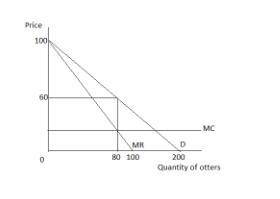

Jack and Annie are the only sellers of otters in a three-state area. The inverse market demand for otters is given by P = 100-0.5Q, where Q = the total quantity offered for sale in the marketplace. Specifically, Q = 4 + 4A, where q, is the amount of otters offered for sale by Jack and qa is the amount offered for sale by Annie. Both Jack and Annie can produce otters at a constant marginal and average total cost of $20. a. Graph the market demand curve. What would be the prevailing price and quantity if this industry were controlled by a monopolist? b. Suppose that Jack solves

part (a) and announces that he will bring half of the monopoly quantity to market each day. What would be the profit-maximizing quantity for Annie to produce? c. Given your answers to (b), what will the industry quantity and final price of otters be? How much profit will Annie earn? Jack? d. Suppose that Jack observes Annie's output from part (b). Find Jack's residual demand and marginal revenue curves, and determine if Jack should adjust his output in response to Annie's choice of A. What will the new price of otters be? e. Is the outcome you found in part (d) an equilibrium outcome? How do you know?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:50, clwalling04

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning

Answers: 2

Business, 22.06.2019 13:10, legendman27

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows. direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow. fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

Business, 22.06.2019 22:10, jeanieb

Consider the labor market for computer programmers. during the late 1990s, the value of the marginal product of all computer programmers increased dramatically. holding all else equal, what effect did this process have on the labor market for computer programmers? the equilibrium wagea. increased, and the equilibrium quantity of labor decreased. b. decreased, and the equilibrium quantity of labor increased. c. increased, and the equilibrium quantity of labor increased. d. decreased, and the equilibrium quantity of labor decreased.

Answers: 3

You know the right answer?

Jack and Annie are the only sellers of otters in a three-state area. The inverse market demand for o...

Questions in other subjects:

Social Studies, 29.10.2020 23:00