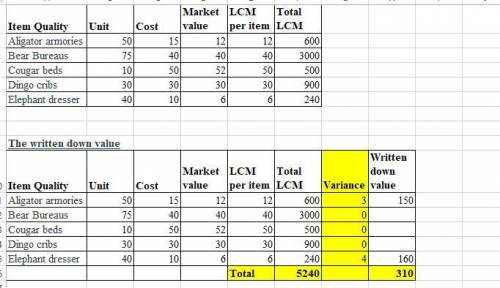

Peterson Furniture Designs is preparing the annual financial statements dated December 31. Ending inventory information about the five major items stocked for regular sale follows:

Item Quality Unit Cost market value

Aligator armories 50 $15 $12

Bear Bureaus 75 40 40

Cougar beds 10 50 52

Dingo cribs 30 30 30

Elephant dresser 40 10 6

Compute the amount of the total write-down when the LCM/NRV rule is applied to each item.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:30, cheyannehatton

Suppose that two firms produce differentiated products and compete in prices. as in class, the two firms are located at two ends of a line one mile apart. consumers are evenly distributed along the line. the firms have identical marginal cost, $60. firm b produces a product with value $110 to consumers. firm a (located at 0 on the unit line) produces a higher quality product with value $120 to consumers. the cost of travel are directly related to the distance a consumer travels to purchase a good. if a consumerhas to travel a mile to purchase a good, the incur a cost of $20. if they have to travel x fraction of a mile, they incur a cost of $20x. (a) write down the expressions for how much a consumer at location d would value the products sold by firms a and b, if they set prices p_{a} and p_{b} ? (b) based on your expressions in (a), how much will be demanded from each firm if prices p_{a} and p_{b} are set? (c) what are the nash equilibrium prices?

Answers: 3

Business, 22.06.2019 16:10, safiyyahrahman6907

From what part of income should someone take savings?

Answers: 2

Business, 23.06.2019 02:20, J3ak06

Kubin company’s relevant range of production is 18,000 to 22,000 units. when it produces and sells 20,000 units, its average costs per unit are as follows: average cost per unit direct materials $ 7.00 direct labor $ 4.00 variable manufacturing overhead $ 1.50 fixed manufacturing overhead $ 5.00 fixed selling expense $ 3.50 fixed administrative expense $ 2.50 sales commissions $ 1.00 variable administrative expense $ 0.50 required: 1. for financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. for financial accounting purposes, what is the total amount of period costs incurred to sell 20,000 units? 3. for financial accounting purposes, what is the total amount of product costs incurred to make 22,000 units? 4. for financial accounting purposes, what is the total amount of period costs incurred to sell 18,000 units?

Answers: 1

You know the right answer?

Peterson Furniture Designs is preparing the annual financial statements dated December 31. Ending in...

Questions in other subjects:

History, 04.02.2021 20:40

Mathematics, 04.02.2021 20:40

Mathematics, 04.02.2021 20:40

Business, 04.02.2021 20:40

Mathematics, 04.02.2021 20:40

Mathematics, 04.02.2021 20:40

Mathematics, 04.02.2021 20:40

Social Studies, 04.02.2021 20:40

Arts, 04.02.2021 20:40