Business, 18.03.2020 18:19 richdakid26

John (age 59 and single) has earned income of $4,200. He has $36,700 of unearned (capital gain) income.

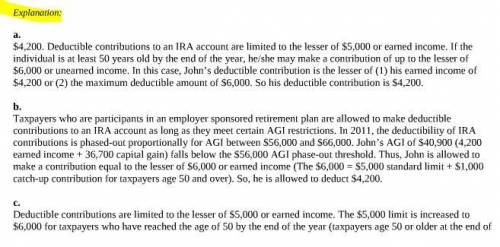

a. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2013?

b. If he does participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2013?

c. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2019 if he has earned income of $19,200?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 14:30, jraemier5861

Island novelties, inc., of palau makes two products—hawaiian fantasy and tahitian joy. each product's selling price, variable expense per unit and annual sales volume are as follows:

Answers: 2

Business, 21.06.2019 19:40, farrellandnandi

Which of the following is false regarding the links between jit and quality? a. jit increases the cost of obtaining good quality. b. as quality improves, fewer inventory buffers are needed; in turn, jit performs better. c. jit reduces the number of potential sources of error by shrinking queues and lead times. d. inventory hides bad quality; jit immediately exposes it. e. if consistent quality exists, jit allows firms to reduce all costs associated with inventory.

Answers: 3

Business, 22.06.2019 09:30, kingtrent81

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $385,000; cash paid for rent, $49,000; cash paid to employees for services rendered during the year, $129,000; cash paid for utilities, $59,000. in addition, you determine that customers owed the company $69,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,900 at year-end, and the rent payment was for a two-year period.

Answers: 1

Business, 22.06.2019 17:00, adrianbanuelos1999

Cooper sues company a in state court in south carolina, where he lives, for negligence alleging personal injury and property damage of $100,000 after a truck driven by an employee of company a rear-ended his pickup truck. company a is incorporated in delaware, has its headquarters in new york, but does a substantial amount of business in south carolina. claiming diversity of citizenship, company a seeks removal to federal district court, but cooper opposes the motion. which of the following is true regarding whether the case may be properly removed to federal district court? the amount in controversy satisfies diversity requirements; and if company a's nerve center is in a state other than south carolina, then the case may be properly removed to federal court. the amount in controversy satisfies diversity requirements; and because company a is incorporated and has its headquarters in a state other than south carolina, the case may be properly removed to federal court. because the amount in controversy satisfies diversity requirements and company a is incorporated in a state other than south carolina, the case may be properly removed to federal court regardless of where company a's headquarters, nerve center, or principal place of business is located. because the amount in controversy satisfies diversity requirements and company a is headquartered in a state other than south carolina, the case may be properly removed to federal court regardless of where company a is incorporated and regardless of the location of its nerve center. because the amount in controversy fails to satisfy jurisdictional requirements, regardless of the location of company a, the case may not be removed to federal court.

Answers: 1

You know the right answer?

John (age 59 and single) has earned income of $4,200. He has $36,700 of unearned (capital gain) inco...

Questions in other subjects:

Mathematics, 03.12.2020 23:20

English, 03.12.2020 23:20

Mathematics, 03.12.2020 23:20

Mathematics, 03.12.2020 23:20