Business, 17.03.2020 04:38 loredobrooke5245

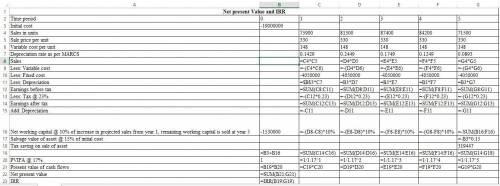

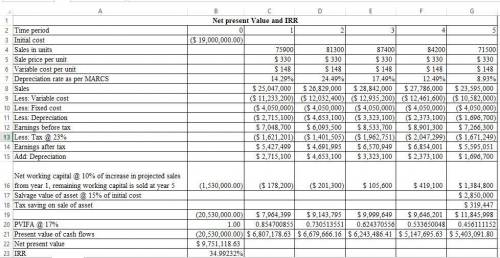

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Year Unit Sales 1 75,900 2 81,300 3 87,400 4 84,200 5 71,500 Production of the implants will require $1,530,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $4,050,000 per year, variable production costs are $148 per unit, and the units are priced at $330 each. The equipment needed to begin production has an installed cost of $19,000,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as 7-year MACRS property. In five years, this equipment can be sold for about 15 percent of its acquisition cost. The company is in the 23 percent marginal tax bracket and has a required return on all its projects of 17 percent. MACRS schedule. What is the NPV of the project?What is the IRR of the project?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, aylineorozco836

Juniper company uses a perpetual inventory system and the gross method of accounting for purchases. the company purchased $9,750 of merchandise on august 7 with terms 1/10, n/30. on august 11, it returned $1,500 worth of merchandise. on august 26, it paid the full amount due. the correct journal entry to record the merchandise return on august 11 is:

Answers: 3

Business, 22.06.2019 06:20, karankhatri1946

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u. s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

Business, 22.06.2019 11:00, roseemariehunter12

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e. g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

You know the right answer?

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Yea...

Questions in other subjects:

English, 10.02.2022 02:50

History, 10.02.2022 02:50

Mathematics, 10.02.2022 02:50

Social Studies, 10.02.2022 02:50