Business, 16.03.2020 16:56 elissiashontelbrown

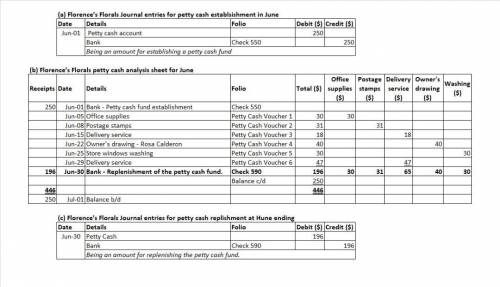

Florence’s Florals, a retail business, started a $250 petty cash fund on June 1. Below are descriptions of the transactions to establish the petty cash fund, disburse petty cash during June, and replenish the petty cash fund on June 30. DATE TRANSACTIONS June 1 Issued Check 550 for $250 to establish a petty cash fund. 5 Paid $30 from the petty cash fund for office supplies, Petty Cash Voucher 1. 8 Paid $31 from the petty cash fund for postage stamps, Petty Cash Voucher 2. 15 Paid $18 from the petty cash fund for delivery service, Petty Cash Voucher 3. 22 Paid $40 from the petty cash fund to the owner, Rosa Calderon, for her personal use, Petty Cash Voucher 4. 25 Paid $30 from the petty cash fund to have the store windows washed, Petty Cash Voucher 5. 29 Paid $47 from the petty cash fund for delivery service, Petty Cash Voucher 6. 30 Issued Check 590 for $196 to replenish the petty cash fund. Required: Record the transaction to establish the petty cash fund on June 1 in a general journal. Record all transactions on a petty cash analysis sheet. Record the transaction to replenish the petty cash fund on June 30 in the general journal.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:30, ingle75

Fill in the missing words to correctly complete each sentence about analyzing a job posting. when reviewing a job posting, it’s important to check theto determine whether it’s worth your time to apply. if the post has been up for a while or it’s already closed, move on to the next position. if it’s still available, take note of when it closes so you’ll know when you mayfrom the company in regard to an interview.

Answers: 1

Business, 22.06.2019 08:30, laurabwhiddon

The production manager of rordan corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st quarter 2nd quarter 3rd quarter 4th quarter units to be produced 10,800 8,500 7,100 11,200 each unit requires 0.25 direct labor-hours, and direct laborers are paid $20.00 per hour. required: 1. prepare the company’s direct labor budget for the upcoming fiscal year. assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. prepare the company’s direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. instead, assume that the company’s direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 2,500 hours of work each quarter. if the number of required direct labor-hours is less than this number, the workers are paid for 2,500 hours anyway. any hours worked in excess of 2,500 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Answers: 2

Business, 22.06.2019 20:10, elora2007

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept, the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year. to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 22.06.2019 21:00, TH3L0N3W0LF

The purpose of the transportation approach for location analysis is to minimize which of the following? a. total costsb. total fixed costsc. the number of shipmentsd. total shipping costse. total variable costs

Answers: 1

You know the right answer?

Florence’s Florals, a retail business, started a $250 petty cash fund on June 1. Below are descripti...

Questions in other subjects:

Mathematics, 20.09.2019 20:30

Mathematics, 20.09.2019 20:30

Social Studies, 20.09.2019 20:30

Spanish, 20.09.2019 20:30

History, 20.09.2019 20:30

History, 20.09.2019 20:30