Business, 11.03.2020 18:12 heebi4jeebi

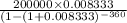

Amortizing loans Suppose that you take out a 30-year mortgage loan of $200,000 at an interest rate of 10%. a. b. c. A)What is your total monthly payment? B)How much of the first month’s payment goes to reduce the size of the loan? C)How much of the payment after two years goes to reduce the size of the loan?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:00, tiffanibell71

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 18:00, Elephants12

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

Business, 22.06.2019 21:10, leo4687

Match the terms with their correct definition. terms: 1. accounts receivable 2. other receivables 3 debtor 4. notes receivable 5. maturity date 6. creditor definitions: a. the party to a credit transaction who takes on an obligation/payable. b. the party who receives a receivable and will collect cash in the future. c. a written promise to pay a specified amount of money at a particular future date. d. the date when the note receivable is due. e. a miscellaneous category that includes any other type of receivable where there is a right to receive cash in the future. f. the right to receive cash in the future from customers for goods sold or for services performed.

Answers: 1

You know the right answer?

Amortizing loans Suppose that you take out a 30-year mortgage loan of $200,000 at an interest rate o...

Questions in other subjects:

Physics, 20.10.2020 19:01

Biology, 20.10.2020 19:01

Mathematics, 20.10.2020 19:01

Mathematics, 20.10.2020 19:01

Mathematics, 20.10.2020 19:01

................1

................1