Business, 11.03.2020 04:26 sierravick123owr441

Head-First Company plans to sell 4,400 bicycle helmets at $78 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $50,300 (includes fixed factory overhead and fixed selling and administrative expense).

Refer to the list below for the exact wording of text items within your income statement.

Amount Descriptions

Operating income

Operating loss

Sales

Total contribution margin

Total fixed expense

Total variable expense

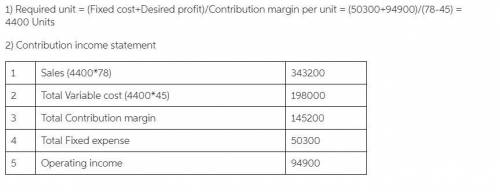

1. Calculate the number of helmets Head-First must sell to earn operating income of $94,900.

helmets:

2. Check your answer by preparing a contribution margin income statement based on the number of units calculated. Refer to the list of Amount Descriptions for the exact wording of text items within your income statement.

Head-First Company

Contribution Margin Income Statement

Based on Helmets Sold

1.Sales

2.Total Revenue Expense

3.Total Contribution margin

4.Total fixed expense 50,300

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 13:30, starlodgb1971

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

Business, 22.06.2019 15:00, nando3024

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor. required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 22:30, josephinekiim

Luggage world buys briefcases with an invoice date of september 28. the terms of sale are 2/10 eom. what is the net date for this invoice

Answers: 1

Business, 22.06.2019 23:30, acharity196

Sally has a high-paying management position with a fortune 500 company, but she is tired of working for corporate america. so sally has decided to start a business, and she knows she will be successful as an entrepreneur because entrepreneurs typically

Answers: 3

You know the right answer?

Head-First Company plans to sell 4,400 bicycle helmets at $78 each in the coming year. Unit variable...

Questions in other subjects:

Mathematics, 26.01.2021 19:00

Biology, 26.01.2021 19:00