Business, 10.03.2020 09:14 skylarsikora22

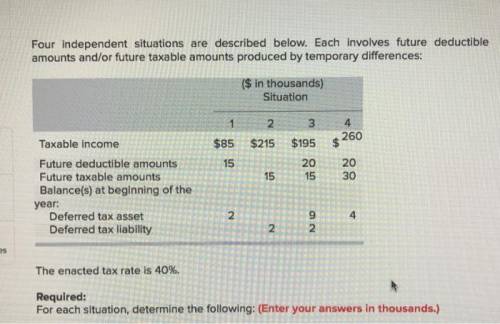

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

($ in thousands)

Situation

1 2 3 4

Taxable income $85 $215 $195 $260

Future deductible amounts 15 20 20

Future taxable amounts 15 15 30

Balance(s) at beginning of the year:

Deferred tax asset 2 9 4

Deferred tax liability 2 2

The enacted tax rate is 40%.

Required:

For each situation, determine the following:

a. Income tax payable currently.

b. Deferred tax asset—balance.

c. Deferred tax asset—change (dr) cr.

d. Deferred tax liability—balance.

e. Deferred tax liability—change (dr) cr.

f. Income tax expense.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:00, bob7220

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Business, 22.06.2019 13:10, legendman27

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows. direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow. fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

Business, 22.06.2019 19:00, 3peak101

Andy purchases only two goods, apples (a) and kumquats (k). he has an income of $125 and can buy apples at $5 per pound and kumquats at $5 per pound. his utility function is u(a, k) = 6a + 2k. what is his marginal utility for apples and his marginal utility for kumquats? andy's marginal utility for apples (mu subscript a) is mu subscript aequals 6 and his marginal utility for kumquats (mu subscript k) is

Answers: 2

Business, 22.06.2019 20:30, BeverlyFarmer

Discuss ways that oracle could provide client customers with the ability to form better relationships with customers.

Answers: 3

You know the right answer?

Four independent situations are described below. Each involves future deductible amounts and/or futu...

Questions in other subjects:

Mathematics, 29.10.2019 06:31

History, 29.10.2019 06:31

Mathematics, 29.10.2019 06:31

Biology, 29.10.2019 06:31