Business, 10.03.2020 08:29 AnkitDavid1616

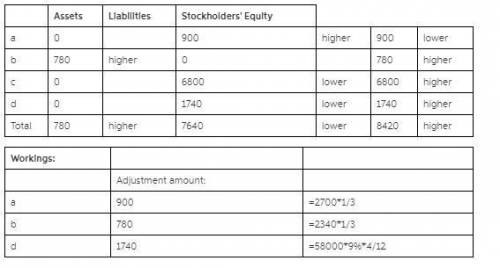

Consider the following situations for Shocker: a. On November 28, 2018, Shocker receives a $2,700 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited. b. On December 1, 2018, the company pays a local radio station $2,340 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited. c. Employee salaries for the month of December totaling $6,800 will be paid on January 7, 2016. d. On August 31, 2018, Shocker borrows $58,000 from a local bank. A note is signed with principal and 9% interest to be paid on August 31, 2019. Required: Indicate by how much the assets, liabilities, and stockholders' equity in the December 31, 2018, balance sheet is higher or lower if the adjustment is not recorded. (If none of the categories apply for a particular item, leave the cell blank.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:30, ThunderThighsM8

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 22.06.2019 02:00, gracye

Kenney co. uses process costing to account for the production of canned energy drinks. direct materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. equivalent units have been calculated to be 19,200 units for materials and 16,000 units for conversion costs. beginning inventory consisted of $11,200 in materials and $6,400 in conversion costs. april costs were $57,600 for materials and $64,000 for conversion costs. ending inventory still in process was 6,400 units (100% complete for materials, 50% for conversion). the total cost per unit using the weighted average method would be closest to:

Answers: 2

Business, 22.06.2019 13:10, princessgabbee8452

Paid-in-capital in excess of par represents the amount of proceeds a. from the original sale of common stock b. in excess of the par value from the original sale of common stock c. at the current market value of the common stock d. at the curent book value of the common stock

Answers: 1

Business, 22.06.2019 20:20, laidbackkiddo412

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

Consider the following situations for Shocker: a. On November 28, 2018, Shocker receives a $2,700 pa...

Questions in other subjects:

Mathematics, 11.11.2020 03:30

English, 11.11.2020 03:30

Mathematics, 11.11.2020 03:30