Business, 10.03.2020 04:37 Jazzy4real

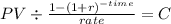

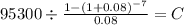

Grouper Excavating Inc. is purchasing a bulldozer. The equipment has a price of $95,300. The manufacturer has offered a payment plan that would allow Grouper to make 7 equal annual payments of $18,935.22, with the first payment due one year after the purchaseA. How much total interest will Grouper pay on this payment plan? $37,247B. Grouper could borrow $95,300 from its bank to finance the purchase at an annual rate of 8%. Should Grouper borrow from the bank or use the manufacturer’s payment plan to pay for the equipment? Borrow From The Bank. What is the Manufacturers rate

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:30, brittd2728

Martha is the head of the accounts department in a small manufacturing company. the company follows the accrual-basis method of accounting. it recently purchased raw materials worth $5,000 from its vendors. however, the company paid only $3,000 to its vendors. it plans to pay the remaining amount after three months. considering this information, which entry should martha record in the company’s accounts? a. $5,000 as accounts receivable b. $3,000 as accounts payable c. $2,000 as accounts payable d. $2,000 as accounts receivable

Answers: 3

Business, 22.06.2019 09:20, eelebron0905

Which statement best defines tuition? tuition is federal money awarded to a student. tuition is aid given to a student by an institution. tuition is money borrowed to pay for an education. tuition is the price of attending classes at a school.

Answers: 1

Business, 22.06.2019 20:20, abbz13

Which statement is not true about a peptide bond? which statement is not true about a peptide bond? the peptide bond has partial double-bond character. the carbonyl oxygen and the amide hydrogen are most often in a trans configuration with respect to one another. rotation is restricted about the peptide bond. the peptide bond is longer than the typical carbon-nitrogen bond.

Answers: 2

Business, 22.06.2019 20:40, nikolas36

Aggart technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt. the stock issue would have no effect on total assets, the interest rate taggart pays, ebit, or the tax rate. which of the following is likely to occur if the company goes ahead with the stock issue? a. the roa will decline. b. taxable income will decline. c. the tax bill will increase. d. net income will decrease. e. the times-interest-earned ratio will decrease

Answers: 1

You know the right answer?

Grouper Excavating Inc. is purchasing a bulldozer. The equipment has a price of $95,300. The manufac...

Questions in other subjects:

History, 02.02.2021 05:10

Social Studies, 02.02.2021 05:10

World Languages, 02.02.2021 05:10

Mathematics, 02.02.2021 05:10

Biology, 02.02.2021 05:10

Mathematics, 02.02.2021 05:10