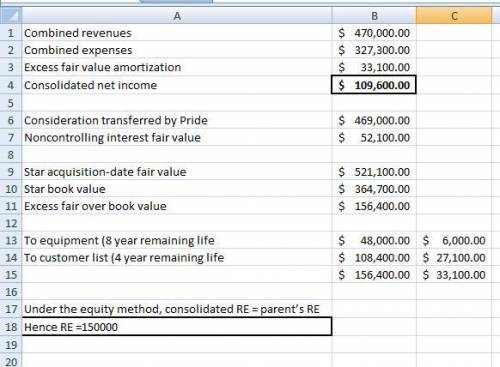

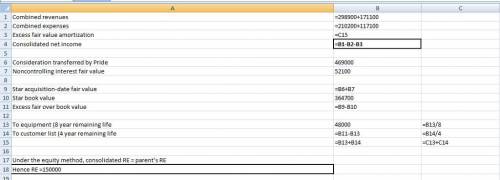

On January 1, 2016, Pride Corporation purchased 90 percent of the outstanding voting shares of Star, Inc. for $469,000 cash. The acquisition-date fair value of the noncontrolling interest was $52,100. At January 1, 2016, Star’s net assets had a total carrying amount of $364,700. Equipment (eight-year remaining life) was undervalued on Star’s financial records by $48,000. Any remaining excess fair value over book value was attributed to a customer list developed by Star (four-year remaining life), but not recorded on its books. Star recorded net income of $42,000 in 2016 and $48,000 in 2017. Each year since the acquisition, Star has declared a $12,000 dividend. At January 1, 2018, Pride’s retained earnings show a $150,000 balance.

Selected account balances for the two companies from their separate operations were as follows:

Pride Star

2018 Revenues $ 298,900 $ 171,100

2018 Expenses 210,200 117,100

Assuming that Pride, in its internal records, accounts for its investment in Star using the equity method, what amount of retained earnings would Pride report on its January 1, 2018 consolidated balance sheet?

What is consolidated net income for 2018?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:10, gia2038

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

Business, 22.06.2019 19:10, sierravick123owr441

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

Business, 22.06.2019 21:40, goku4420

Inventory by three methods; cost of goods sold the units of an item available for sale during the year were as follows: jan. 1 inventory 20 units at $1,800 may 15 purchase 31 units at $1,950 aug. 7 purchase 13 units at $2,040 nov. 20 purchase 16 units at $2,100 there are 18 units of the item in the physical inventory at december 31. determine the cost of ending inventory and the cost of goods sold by three methods, presenting your answers in the following form: round your final answers to the nearest dollar. cost inventory method ending inventory cost of goods sold a. first-in, first-out method $ $ b. last-in, first-out method $ $ c. weighted average cost method $ $

Answers: 3

You know the right answer?

On January 1, 2016, Pride Corporation purchased 90 percent of the outstanding voting shares of Star,...

Questions in other subjects:

Law, 08.02.2021 18:30

English, 08.02.2021 18:30

English, 08.02.2021 18:30

Mathematics, 08.02.2021 18:30

Mathematics, 08.02.2021 18:30

Mathematics, 08.02.2021 18:30