Business, 07.03.2020 03:11 mlbowman3644

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $190,000 are payable at the beginning of each year. Each is a finance lease for the lessee.

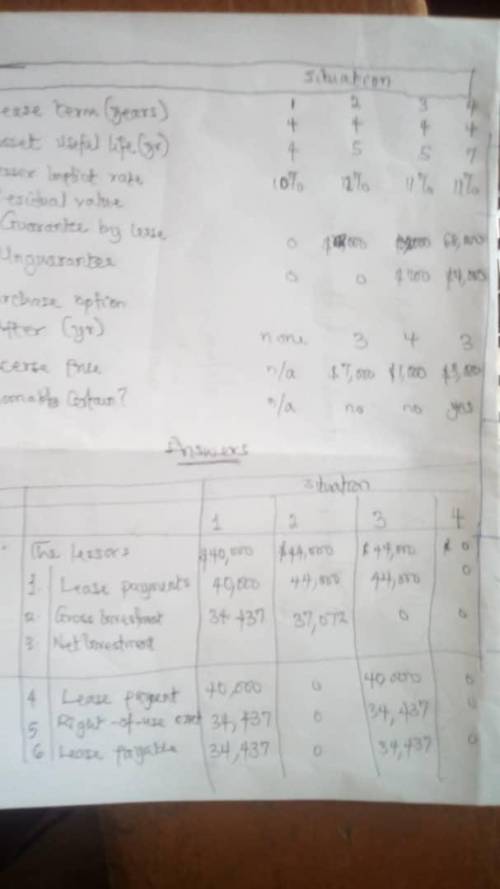

Situation

1 2 3 4

Lease term (years) 7 7 8 8

Lessor's and lessee's interest rate 10% 12% 11% 11%

Residual value:

Estimated fair value 0 $68,000 $9,800 $68,000

Guaranteed by lessee 0 0 $9,800 $78,000

Determine the following amounts at the beginning of the lease

Situation

1 2 3 4

A The lessor's:

1 Lease payments

2 Gross investment in the lease

3 Net investment in the lease

B The lessee's:

4 Lease payments

5 Right-of-use asset

6 Lease payable

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:00, kimmmmmmy333

Assume today is december 31, 2013. barrington industries expects that its 2014 after-tax operating income [ebit(1 – t)] will be $400 million and its 2014 depreciation expense will be $70 million. barrington's 2014 gross capital expenditures are expected to be $120 million and the change in its net operating working capital for 2014 will be $25 million. the firm's free cash flow is expected to grow at a constant rate of 4.5% annually. assume that its free cash flow occurs at the end of each year. the firm's weighted average cost of capital is 8.6%; the market value of the company's debt is $2.15 billion; and the company has 180 million shares of common stock outstanding. the firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. using the corporate valuation model, what should be the company's stock price today (december 31, 2013)? round your answer to the nearest cent. do not round intermediate calculations.

Answers: 1

Business, 22.06.2019 23:40, step35

When randy, a general manager of a national retailer, moved to a different store in his company that was having difficulty, he knew that sales were low and after talking to his employees, he found morale was also low. at first randy thought attitudes were poor due to low sales, but after working closely with employees, he realized that the poor attitudes were actually the cause of poor sales. randy was able to discover the cause of the problem by utilizing skills.

Answers: 2

Business, 23.06.2019 03:00, sahaitong2552

What is the w-4 form used for? filing taxes with the federal government determining the amount of money an employee has paid out in taxes calculating how much tax should be withheld from a person’s paycheck calculating how much income was paid in the previous year

Answers: 1

Business, 23.06.2019 05:00, autumnlyons69

Choose a well-known company that you know of, and describe its direct and indirect competitors. choose a well-known company that you know of, and describe its direct and indirect competitors. describe at least three direct competitors and three indirect competitors. at least three direct competitors and three indirect competitors.

Answers: 2

You know the right answer?

Each of the four independent situations below describes a sales-type lease in which annual lease pay...

Questions in other subjects:

Computers and Technology, 20.09.2019 23:00

History, 20.09.2019 23:00

Chemistry, 20.09.2019 23:00

Geography, 20.09.2019 23:00

History, 20.09.2019 23:00

Health, 20.09.2019 23:00