Business, 06.03.2020 23:58 emojigirl2824

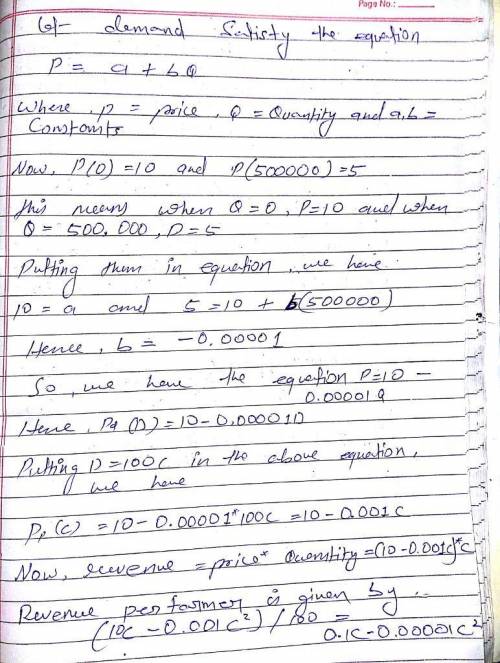

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested by every farmer depends on the weather: sunny weather yields more com than cloudy weather during the growing season. All corn is harvested simultaneously, and the price per bushel is determined by a market demand function. Suppose the price dem and function P = Pl(D) is such that Pa (0-10 dollars and Pa (500000-5 dollars, and Pi (D) is linear in D, the demand in bushels. Then (1) price in terms of demand Pd(D10-0.000010 dollars Through supply and demand equality, the demand equals the total crop size. The amounts produced on different farms are all perfectly correlated and there are a total of 100 farms, and thus D- 100C, Then (2) price in terms of production P Then from selling the crop, each farmer has (3) revenue from production Rp(C) - dollars IC- 00001C"(2) dollars This shows that the revenue is a nonlinear function of the underlying variable C. Because of the weather, C is random and each farmer faces nonlinear risk. Can a farmer hedge this risk in advance by participating in the futures market for corn? Since the farmer is ultimately going to sell his corn harvest at the (risky) spot price, it might be prudent to sell some corn now at a known price in the futures market. Indeed, if the farmer knew exactly how much con he would produce, and only the price were uncertain, he could implement an equal and opposite policy by shorting this amount in the corn futures market. Let C be the expected corn production. Let P Pp(C) be the expected price at future time T Suppose the farmer enters into h corn future contracts, where < 0 represents the sale of (-h) > 0 bushels of corn at time T for P per bushel, and h > 0 represents purchase of h bushels of corn at time T for P per bushel

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:20, leshayellis1591

Lusk corporation produces and sells 14,300 units of product x each month. the selling price of product x is $25 per unit, and variable expenses are $19 per unit. a study has been made concerning whether product x should be discontinued. the study shows that $72,000 of the $102,000 in monthly fixed expenses charged to product x would not be avoidable even if the product was discontinued. if product x is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

Answers: 1

Business, 22.06.2019 20:20, Hi123the

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested...

Questions in other subjects:

Mathematics, 29.01.2021 05:30

Mathematics, 29.01.2021 05:30