Business, 06.03.2020 23:39 brenda0113hernandez

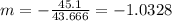

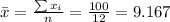

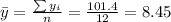

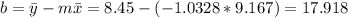

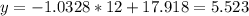

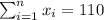

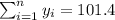

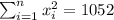

The owner of Maumee Ford-Mercury-Volvo wants to study the relationship between the age of a car and its selling price. Listed below is a random sample of 12 used cars sold at the dealership during the last year. Car Age (years) Selling Price ($1000) Car Age (years) Selling Price ($1000)1 9 12.0 7 9 8.92 8 10.9 8 11 9.73 10 4.6 9 10 9.74 12 4.3 10 12 2.75 9 5.6 11 6 10.66 8 13.5 12 6 8.9(a) Determine the regression equation. (Round your answers to 3 decimal places. Negative values should be indicated by a minus sign.)(b) Estimate the selling price of a 12-year-old car (in $1000). (Round your answer to 3 decimal places.)(c) Interpret the regression equation (in dollars). (Round your answer to nearest dollar amount.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:40, gobertbrianna40

Job a3b was ordered by a customer on september 25. during the month of september, jaycee corporation requisitioned $2,400 of direct materials and used $3,900 of direct labor. the job was not finished by the end of the month, but needed an additional $2,900 of direct materials in october and additional direct labor of $6,400 to finish the job. the company applies overhead at the end of each month at a rate of 100% of the direct labor cost. what is the amount of job costs added to work in process inventory during october?

Answers: 3

Business, 22.06.2019 17:20, andrespeerman

States that if there is no specific employment contract saying otherwise, the employer or employee may end an employment relationship at any time, regardless of cause. rule of fair treatment due-process policy rule of law employment flexibility employment at will

Answers: 1

Business, 22.06.2019 20:20, laidbackkiddo412

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

The owner of Maumee Ford-Mercury-Volvo wants to study the relationship between the age of a car and...

Questions in other subjects:

Mathematics, 14.05.2021 06:30

Spanish, 14.05.2021 06:30

Mathematics, 14.05.2021 06:30

Mathematics, 14.05.2021 06:30

Mathematics, 14.05.2021 06:30

History, 14.05.2021 06:30