Business, 06.03.2020 23:27 Ksedro1998

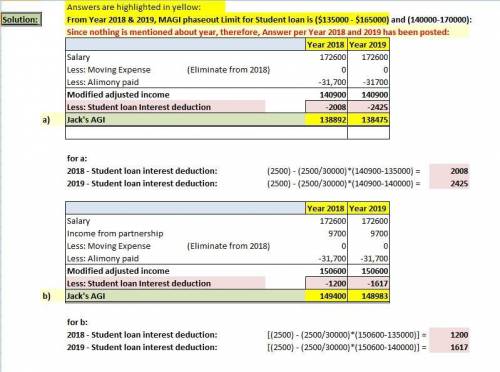

This year Jack intends to file a married-joint return with two dependents. Jack received $172,600 of salary and paid $7,200 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid qualified moving expenses of $5,250 and $31,700 of alimony. (Do not round intermediate calculations.)

a.

What is Jack's adjusted gross income? Assume that Jack will opt to treat tax items in a manner to minimize his AGI.

b.

Suppose that Jack also reported income of $9,700 from a half share of profits from a partnership. Disregard any potential self-employment taxes on this income. What AGI would Jack report under these circumstances? Again, assume that Jack will opt to treat tax items in a manner to minimize his AGI. What's Jack's AGI?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:00, PanjiUR9220

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 11:30, zitterkoph

Leticia has worked for 20 years in the public relations department of a large firm and has been the vice-president for the past ten years. it is unlikely she will ever be promoted to the top executive position in her firm even though she has directed several successful projects and is quite capable. her lack of promotion is an illustration of (a) the "glass ceiling" (b) the "glass elevator" (c) the "mommy track" (d) sexual harassment

Answers: 3

Business, 22.06.2019 12:40, hardwick744

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

Business, 22.06.2019 19:00, sharri44

Read the scenario. alfonso is 19 years old and has a high school diploma. recently, he was promoted to assistant manager at the fast-food restaurant where he has worked since the age of sixteen. his dream is to become the restaurant’s manager. what is his best option for achieving his dream? he should find another job and work his way up to a higher position. he should hope that his manager transfers to another location and that he is his replacement. he should attend classes at the local college to receive training in management. he should work hard, work longer hours, and remain assistant manager.

Answers: 2

You know the right answer?

This year Jack intends to file a married-joint return with two dependents. Jack received $172,600 of...

Questions in other subjects:

Chemistry, 13.10.2020 05:01

Mathematics, 13.10.2020 05:01

English, 13.10.2020 05:01