Business, 06.03.2020 23:24 cheerthi16

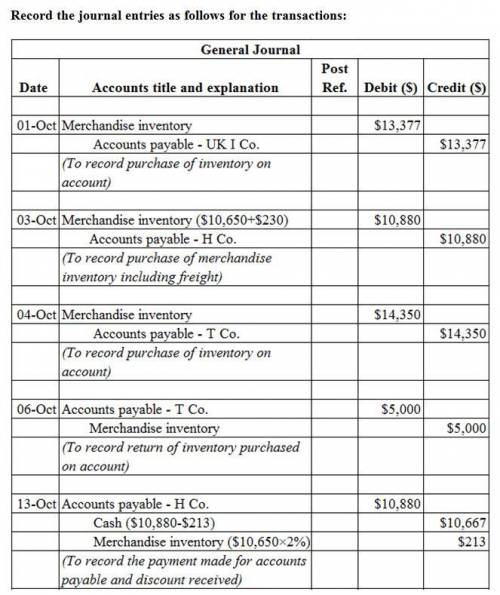

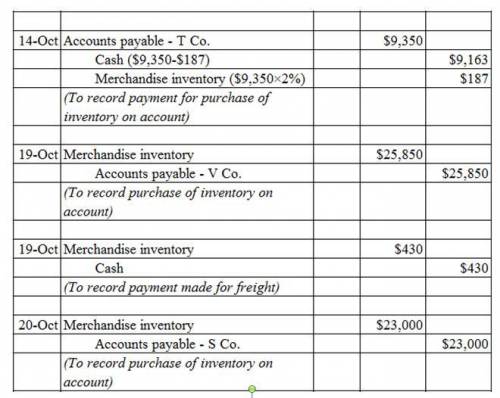

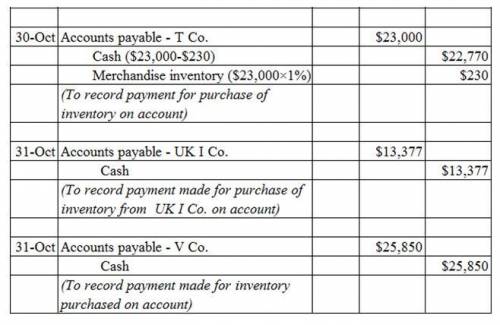

The following selected transactions were completed by Capers Company during October of the current year: Oct. 1 Purchased merchandise from UK Imports Co., $13,377, terms FOB destination, n/30. 3 Purchased merchandise from Hoagie Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $230 was added to the invoice. 4 Purchased merchandise from Taco Co., $14,350, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Taco Co. for $5,000 of merchandise returned from purchase on October 4. 13 Paid Hoagie Co. for invoice of October 3. 14 Paid Taco Co. for invoice of October 4, less debit memo of October 6. 19 Purchased merchandise from Veggie Co., $25,850, terms FOB shipping point, n/eom. 19 Paid freight of $430 on October 19 purchase from Veggie Co. 20 Purchased merchandise from Caesar Salad Co., $23,000, terms FOB destination, 1/10, n/30. 30 Paid Caesar Salad Co. for invoice of October 20. 31 Paid UK Imports Co. for invoice of October 1. 31 Paid Veggie Co. for invoice of October 19. Journalize the entries to record the transactions of Capers Company for October. Refer to the Chart of Accounts for exact wording of account titles.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 06:50, jungcoochie101

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 23.06.2019 00:30, hellothere2458

Activity-based costing (abc) is not truly a cost collection mechanism as much as it is an inventory valuation method. the main purpose for implementing an activity-based cost system is to try to overcome some of the cost distortions that occur in traditional costing from product differences when there are variations in size and complexity. however, one of the disadvantages of utilizing abc is that the additional information gathering necessary to implement costing with that level of detail might be beyond the reach of some companies with resource or financial constraints. with this in mind, what kinds of industries or companies do you think would benefit most from using activity-based costing and why? in designing or modifying an accounting system to capture appropriate costs for abc, what considerations do you think would need to be made?

Answers: 3

You know the right answer?

The following selected transactions were completed by Capers Company during October of the current y...

Questions in other subjects:

Biology, 29.12.2019 19:31

Mathematics, 29.12.2019 19:31

English, 29.12.2019 19:31

Physics, 29.12.2019 19:31

Chemistry, 29.12.2019 19:31