Business, 06.03.2020 03:44 shakira11harvey6

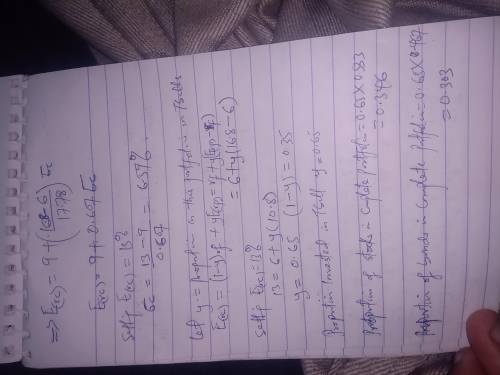

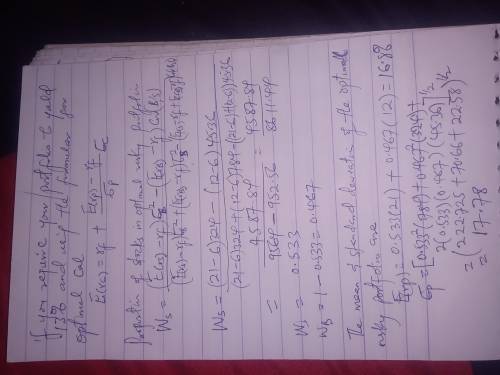

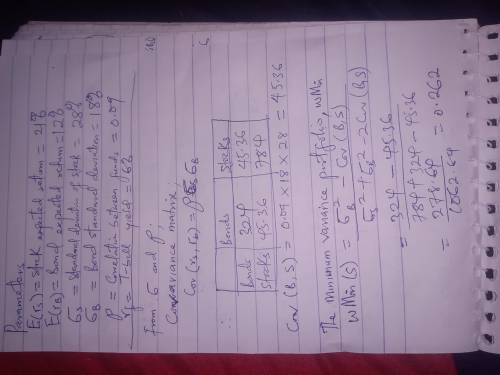

A pension fund manager is considering three mutual funds. the first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a t-bill money market fund that yields a rate of 6%. the probability distribution of the risky funds is as follows: expected return standard deviation stock fund (s) 21 % 28 % bond fund (b) 12 18 the correlation between the fund returns is 0.09. you require that your portfolio yield an expected return of 13%, and that it be efficient, on the best feasible cal.

a. what is the standard deviation of your portfolio? (round your answer to 2 decimal places.)

b. what is the proportion invested in the t-bill fund and each of the two risky funds? (round your answers to 2 decimal places.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:40, alix1234567888

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 22.06.2019 19:30, darkremnant14

Problem page a medical equipment industry manufactures x-ray machines. the unit cost c (the cost in dollars to make each x-ray machine) depends on the number of machines made. if x machines are made, then the unit cost is given by the function =cx+−0.3x2126x31,935 . how many machines must be made to minimize the unit cost?

Answers: 3

Business, 22.06.2019 22:40, tonypewitt

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

Business, 23.06.2019 00:00, silonis21

1. consider a two-firm industry. firm 1 (the incumbent) chooses a level of output qı. firm 2 (the potential entrant) observes qı and then chooses its level of output q2. the demand for the product is p 100 q, where q is the total output sold by the two firms which equals qi +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of qi and q2 keeping in mind that firm 1 chooses qi first and firm 2 observes qi and chooses its q2. find the profits of the two firms-n1 and t2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of qi would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of qi? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f> 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q, denoted by q1', a expression for firm l's profit, when entry is deterred, as a function of f. for what values of f would firm 1 use an entry deterring strategy?

Answers: 3

You know the right answer?

A pension fund manager is considering three mutual funds. the first is a stock fund, the second is a...

Questions in other subjects:

Mathematics, 21.05.2020 01:03

Mathematics, 21.05.2020 01:03

Mathematics, 21.05.2020 01:03