Business, 04.03.2020 04:19 brainewashed11123

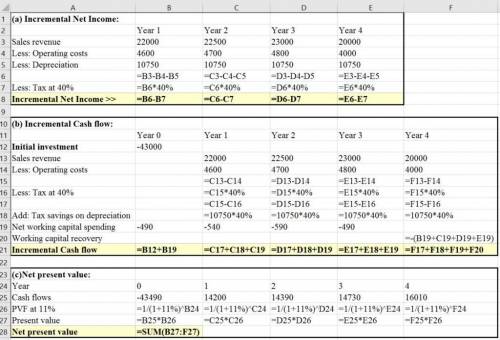

The Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 40 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project.

Year 0 Year 1 Year 2 Year 3 Year 4

Investment $ 43,000

Sales revenue $ 22,000 $ 22,500 $ 23,000 $ 20,000

Operating costs 4,600 4,700 4,800 4,000

Depreciation 10,750 10,750 10,750 10,750

Net working capital spending 490 540 590 490 ?

Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.)

Year 1 Year 2 Year 3 Year 4

Net income $ $ $ $

b.

Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.)

Year 0 Year 1 Year 2 Year 3 Year 4

Cash flow $ $ $ $ $

c.

Suppose the appropriate discount rate is 11 percent. What is the NPV of the project? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e. g., 32.16))

NPV $

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:00, snikergrace

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 07:30, yzafer3971

An instance where sellers should work to keep relationships with customers is when they instance where selllars should work to keep relationships with customers is when they feel that the product

Answers: 1

Business, 22.06.2019 22:50, emanuelmorales1515

Amonopolist’s inverse demand function is p = 150 – 3q. the company produces output at two facilities; the marginal cost of producing at facility 1 is mc1(q1) = 6q1, and the marginal cost of producing at facility 2 is mc2(q2) = 2q2.a. provide the equation for the monopolist’s marginal revenue function. (hint: recall that q1 + q2 = q.)mr(q) = 150 - 6 q1 - 3 q2b. determine the profit-maximizing level of output for each facility. output for facility 1: output for facility 2: c. determine the profit-maximizing price.$

Answers: 3

You know the right answer?

The Best Manufacturing Company is considering a new investment. Financial projections for the invest...

Questions in other subjects:

Mathematics, 11.11.2020 02:20

English, 11.11.2020 02:20

Chemistry, 11.11.2020 02:20

Mathematics, 11.11.2020 02:20

Mathematics, 11.11.2020 02:20

Mathematics, 11.11.2020 02:20