Business, 03.03.2020 04:49 unknown6669

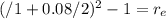

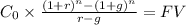

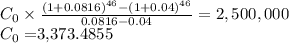

Muhammad, a 21-year old computer engineer, is opening an individual retirement account (IRA) at a bank. His goal is to accumulate $2.5 million in the IRA by the time he retires in 46 years. Muhammad expects his IRA to receive 8% nominal annual interest, compounded semiannually, throughout the 46 years. As a computer engineer, Muhammad believes his salary will increase at a constant 4% annual rate during his career. Muhammad wishes to make annual deposits into his IRA account over the 46 years. He wishes to start his IRA with the lowest possible deposit and then increase his deposit amount at a constant 4% rate each year.

Assuming end-of-year deposits, how much should she deposit the first year?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:10, nat8475

The prebisch–singer hypothesis concludes that: a. technology lowers the cost of manufactured products, so developing countries should see an increase in their terms of trade. b. developing countries experience a long-run decline in their terms of trade, as the demand for primary products in higher-income countries declines relative to their demand for manufactured goods. c. because of unfair trading practices, labor in developing countries is exploited. d. opec has been responsible for a slowdown in the world's standard of living.

Answers: 3

Business, 22.06.2019 11:30, kimjp56io5

Amano s preguntes cationing to come fonds and consumer good 8. why did the u. s. government use rationing for some foods and consumer goods during world war ii?

Answers: 1

Business, 22.06.2019 16:10, ilovemusicandreading

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 16:30, piratesfc02

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

You know the right answer?

Muhammad, a 21-year old computer engineer, is opening an individual retirement account (IRA) at a ba...

Questions in other subjects:

Mathematics, 29.01.2020 11:54

Social Studies, 29.01.2020 11:54

Physics, 29.01.2020 11:54

World Languages, 29.01.2020 11:54

Mathematics, 29.01.2020 11:54

Mathematics, 29.01.2020 11:54

Spanish, 29.01.2020 11:54

Mathematics, 29.01.2020 11:54

Mathematics, 29.01.2020 11:54