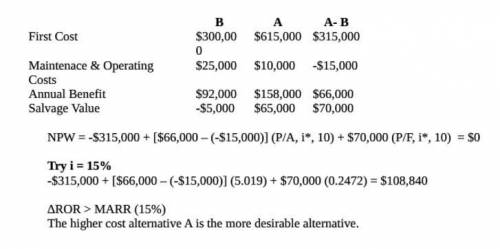

A Two hazardous environment facilities are being evaluated, with the projected life of each facility being 10 years. The company uses a MARR of 15%. Using rate of return analysis, which alternative should be selected?

Alternative A Alternative B

First Cost, $ 615,000 300,000

O & M Cost, $ 10,000 25,000

Annual Benefits, $ 158,000 92,000

Salvage Value, $ 65,000 -5,000

(A) Alt. B

(B) Neither

(C) Alt. A

(D) Either Alt. A or Alt. B

Answers: 1

Other questions on the subject: Business

Business, 23.06.2019 20:00, wrms8379

Afarmer sells $25,000 worth of apples to individuals who take them home to eat, $50,000 worth of apples to a company that uses them all to produce cider, and $75,000 worth of apples to a grocery store that will sell them to households. how much of the farmer's sales will be included as apples in gdp? question 7 options:

Answers: 3

Business, 23.06.2019 22:40, ThatOneGuy8144

Macroeconomics is the field of study which is concerned with the overall performance of the economy. some subsets of this field include

Answers: 2

Business, 24.06.2019 02:00, maleikrocks3497

Matt and alicia created a firm that is a separate legal entity and will share ownership of that firm on a 75/25 basis. which type of entity did they create if they have no personal liability for the firm's debts? limited partnership corporation sole proprietorship general partnership public company

Answers: 3

You know the right answer?

A Two hazardous environment facilities are being evaluated, with the projected life of each facility...

Questions in other subjects:

Computers and Technology, 11.11.2020 07:30

English, 11.11.2020 07:30

Mathematics, 11.11.2020 07:30

History, 11.11.2020 07:30