Business, 29.02.2020 02:53 KindaSmartPersonn

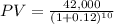

An investment product promises to pay $42,000 at the end of 10 years. If an investor feels this investment should produce a rate of return of 12%, compounded annually, what's the most the investor should be willing to pay for the investment

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 08:00, sanociahnoel

At a student café, there are equal numbers of two types of customers with the following values. the café owner cannot distinguish between the two types of students because many students without early classes arrive early anyway (i. e., she cannot price-discriminate). students with early classes students without early classes coffee 70 60 banana 51 101 the marginal cost of coffee is 10 and the marginal cost of a banana is 40. the café owner is considering three pricing strategies: 1. mixed bundling: price bundle of coffee and a banana for 161, or just a coffee for 70. 2. price separately: offer coffee at 60, price a banana at 101. 3. bundle only: coffee and a banana for 121. do not offer goods separately. assume that if the price of an item or bundle is no more than exactly equal to a student's willingness to pay, then the student will purchase the item or bundle. for simplicity, assume there is just one student with an early class, and one student without an early class. price strategy revenue from pricing strategy cost from pricing strategy profit from pricing strategy 1. mixed bundling $ $ $ 2. price separately $ $ $ 3. bundle only $ $ $ pricing strategy yields the highest profit for the café owner.

Answers: 1

Business, 23.06.2019 20:00, angelmilla

What could explain why a decrease in taxes could lead to a less-than-proportionate increase in output? a. as a result of diminishing returns to current consumption, consumers may choose to spread the extra spending over the long term rather than consuming the proceeds of a tax cut all at once. b. consumers may choose to save much of the tax cut in anticipation of having to pay higher taxes in the future. c. a decrease in taxes will necessitate lower government outlays, thus largely offsetting the higher consumption expenditures of households. d. all of the above. e. a and b only.

Answers: 3

Business, 24.06.2019 00:30, onlymyworld27

When a firm recognizes the critical importance of its employees by attempting to provide good conditions and opportunities, it sets an employee goal?

Answers: 1

You know the right answer?

An investment product promises to pay $42,000 at the end of 10 years. If an investor feels this inve...

Questions in other subjects:

Mathematics, 04.02.2020 04:00

Biology, 04.02.2020 04:00

Mathematics, 04.02.2020 04:00