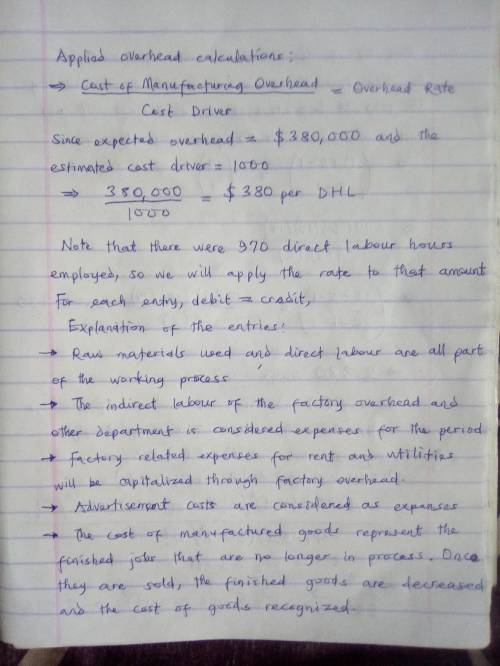

Froya Fabrikker A/S of Bergen, Norway, Is a small company that manufactures specialty heavy equipment for use In North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor- hours. Its predetermined overhead rate was based on a cost formula that estimated $395,600 of manufacturing overhead for an estimated allocation base of 920 direct labor-hours. The following transactions took place during the year:a. Raw materials purchased on account, $290,000.b. Raw materials used In production (all direct materials), $275,000.c. Utility bills incurred on account, $77,000 (90% related to factory operations, and the remainder related to selling and administrative activities).d. Accrued salary and wage costs:Direct labor (970 hours) $320,000Indirect labor $108,000Selling and administrative salaries $200,000e. Maintenance costs incurred on account in the factory, $72,000.f. Advertising costs incurred on account, $154,000.g. Depreciation was recorded for the year, $90,000 (75% related to factory equipment, and the remainder related to selling and administrative equipment)h. Rental cost incurred on account, $115,000 (80% related to factory facilities, and the remainder related to selling and administrative facilities).i. Manufacturing overhead cost was applied to jobs, $ j. Cost of goods manufactured for the year, $950,000.k. Sales for the year (ail on account) totaled $2.100.000. These goods cost $980.000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were:Raw Materials $48,000Work in Process $39,000Finished Goods $78,000Required:1. Prepare journal entries to record the preceding transactions.2. Post your entries to T-accounts. (Don't forget to enter the beginning Inventory balances above.)3. Prepare a schedule of cost of goods manufactured.4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.4B. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:10, flippinhailey

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 11:30, kaylabethany

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

Business, 22.06.2019 13:30, Mariaisagon9050

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

You know the right answer?

Froya Fabrikker A/S of Bergen, Norway, Is a small company that manufactures specialty heavy equipmen...

Questions in other subjects:

Mathematics, 06.05.2021 22:10

Mathematics, 06.05.2021 22:10

Mathematics, 06.05.2021 22:10

History, 06.05.2021 22:10