Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:30, lishalarrickougdzr

ernst's electrical has a bond issue outstanding with ten years to maturity. these bonds have a $1,000 face value, a 5 percent coupon, and pay interest semiminusannually. the bonds are currently quoted at 96 percent of face value. what is ernst's pretax cost of debt?

Answers: 1

Business, 23.06.2019 11:10, chickennbutt0730

Danielle puts 8 percent of her paycheck in a 401(k) plan administered by her employer. danielle earns $55,000 per year and is in the 28 percent tax category. what annual tax savings does she get from her contribution? if her employer matches contributions on the first 5% of her salary dollar for dollar and the second 5% 50 cents on the dollar, how much will her employer put into her account this year?

Answers: 2

Business, 23.06.2019 15:00, kobiemajak

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

Business, 24.06.2019 01:30, kira96

James river jewelry is a small jewelry shop. while james river jewelry does sell typical jewelry purchased from jewelry vendors, including such items as rings, necklaces, earrings, and watches, it specializes in hard-to-find asian jewelry. although some asian jewelry is manufactured jewelry purchased from vendors in the same manner as the standard jewelry is obtained, many of the asian jewelry pieces are often unique single items purchased directly from the artisan who created the piece (the term manufactured would be an inappropriate description of these pieces). james river jewelry has a small but loyal clientele, and it wants to further increase customer loyalty by creating a frequent buyer program. in this program, after every 10 purchases, a customer will receive a credit equal to 50 percent of the average of his or her 10 most recent purchases. this credit must be applied to the next (or 11th) purchase.

Answers: 2

You know the right answer?

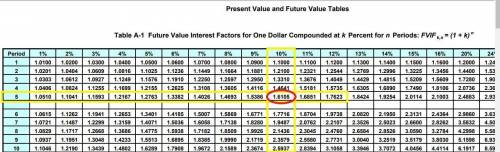

You want to invest $20,000 today to accumulate $32,000 for graduate school. If you can invest at an...

Questions in other subjects:

Mathematics, 31.01.2020 00:50

Mathematics, 31.01.2020 00:50

Mathematics, 31.01.2020 00:50

Physics, 31.01.2020 00:50

Chemistry, 31.01.2020 00:50