Business, 28.02.2020 03:54 abigailweeks10

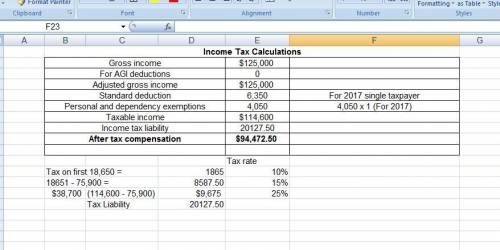

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $125,000 in cash wages. assume Rick files single and is entitled to one personal exemption. Rick deducts the standard deduction instead of itemized deductions. (use the tax rate schedules.)

a. what is the amount of Rocks after-tax compensation (ignore payroll taxes )?( do not round intermediate calculations. round income tax liability and After-tax compensation to 2 decimal places. enter deductions as negative amounts)

1. Gross income

2. for AGI deductions

3. adjusted gross income

4. standard deduction

5. personal and dependency exemptions

6. taxable income

7. income tax liability

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:30, cyaransteenberg

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 09:40, shybug886

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

You know the right answer?

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $...

Questions in other subjects:

Mathematics, 29.10.2021 14:00

History, 29.10.2021 14:00

SAT, 29.10.2021 14:00

SAT, 29.10.2021 14:00

Mathematics, 29.10.2021 14:00