Business, 28.02.2020 00:01 batmanmarie2004

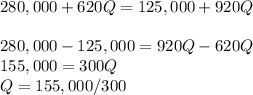

Gabriel Manufacturing must implement a manufacturing process that reduces the amount of toxic by-products Two processes have been identified that provide the same level of toxic by-product reduction. The first process would incur $280,000 of fixed costs and $620 per unit of variable costs. The second process has fixed costs of $125,000 and variable costs of $920 per unit. At what quantity does it not matter which of the two processes is chosen?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:30, benjaminmccutch

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

Business, 22.06.2019 19:30, kylierice1

Exercise 4-9presented below is information related to martinez corp. for the year 2017.net sales $1,399,500 write-off of inventory due to obsolescence $80,440cost of goods sold 788,200 depreciation expense omitted by accident in 2016 43,600selling expenses 65,800 casualty loss 53,900administrative expenses 53,500 cash dividends declared 43,300dividend revenue 22,100 retained earnings at december 31, 2016 1,042,400interest revenue 7,420 effective tax rate of 34% on all items exercise 4-9 presented below is information relateexercise 4-9 presented below is information relate prepare a multiple-step income statement for 2017. assume that 61,500 shares of common stock are outstanding. (round earnings per share to 2 decimal places, e. g. 1.49.)prepare a separate retained earnings statement for 2017. (list items that increase retained earnings first.)

Answers: 2

Business, 22.06.2019 20:10, hsbhxsb

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

Business, 22.06.2019 20:30, jessicaisbaehood

Juanita and sam attend a beach party and notice that the local beach appears to have a great deal more trash washed up on shore than it did when they were young. the water doesn't appear nearly as clear, and there seems to be less evidence of small water creatures living in the shallows. an afternoon at the local library convinces them that one major cause is the new factory nearby. after some discussion, they decide their next step should be identifying the cause of the changes identifying the problem picketing the guilty factory lobbying their elected representatives to complain about the problem talking to a local environmental group about solutions

Answers: 3

You know the right answer?

Gabriel Manufacturing must implement a manufacturing process that reduces the amount of toxic by-pro...

Questions in other subjects:

Mathematics, 13.04.2021 17:40

Mathematics, 13.04.2021 17:40

Mathematics, 13.04.2021 17:40

Mathematics, 13.04.2021 17:40