Business, 27.02.2020 04:33 LaneyMM1401

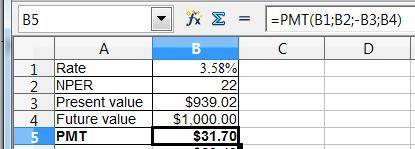

A bond has yield to maturity of 7.15 percent; face value of $1,000; time to maturity of 11 years and pays coupons semiannually. If the price of the bond is $939.02, calculate the coupon rate of the bond.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 14:40, blackkiki5588

Lohn corporation is expected to pay the following dividends over the next four years: $18, $14, $13, and $8.50. afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. if the required return on the stock is 14 percent, what is the current share price?

Answers: 2

Business, 21.06.2019 18:30, tfhdg

Following is stanley black & decker’s income statement for 2016 (in millions): stanley black & decker, inc. income statement for the year ended december 31, 2016 ($ millions) sales $11,406.9 cost of goods sold 7,139.7 gross profit $ 4,267.2 selling, general and administrative expenses 2,602.0 other operating expenses 268.2 operating income 1,397.0 interest and other nonoperating expenses 171.3 income before income tax 1,225.7 income tax expense 261.2 net income $ 964.5 compute stanley black & decker’s gross profit margin.

Answers: 1

Business, 22.06.2019 00:30, kierafisher05

You wants to open a saving account. which account will grow his money the most

Answers: 1

You know the right answer?

A bond has yield to maturity of 7.15 percent; face value of $1,000; time to maturity of 11 years and...

Questions in other subjects:

History, 02.09.2020 19:01

Mathematics, 02.09.2020 19:01

Biology, 02.09.2020 19:01

Mathematics, 02.09.2020 19:01

Mathematics, 02.09.2020 19:01

Business, 02.09.2020 19:01

Mathematics, 02.09.2020 19:01

Mathematics, 02.09.2020 19:01