Business, 26.02.2020 22:04 kjhgfcvb5761

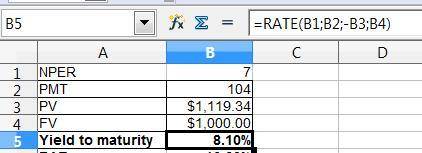

The Petit Chef Co. has 10.4 percent coupon bonds on the market with seven years left to maturity. The bonds make annual payments and have a par value of $1,000. If the bonds currently sell for $1,119.34, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:30, karnun1201

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 14:30, benjaminmccutch

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

Business, 22.06.2019 14:30, kaylahill14211

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

You know the right answer?

The Petit Chef Co. has 10.4 percent coupon bonds on the market with seven years left to maturity. Th...

Questions in other subjects:

Mathematics, 23.02.2021 03:40

Mathematics, 23.02.2021 03:40

Mathematics, 23.02.2021 03:40

History, 23.02.2021 03:40

Mathematics, 23.02.2021 03:40

Mathematics, 23.02.2021 03:40